Symposium on Artha Rin Adalat Ain held at BILIA

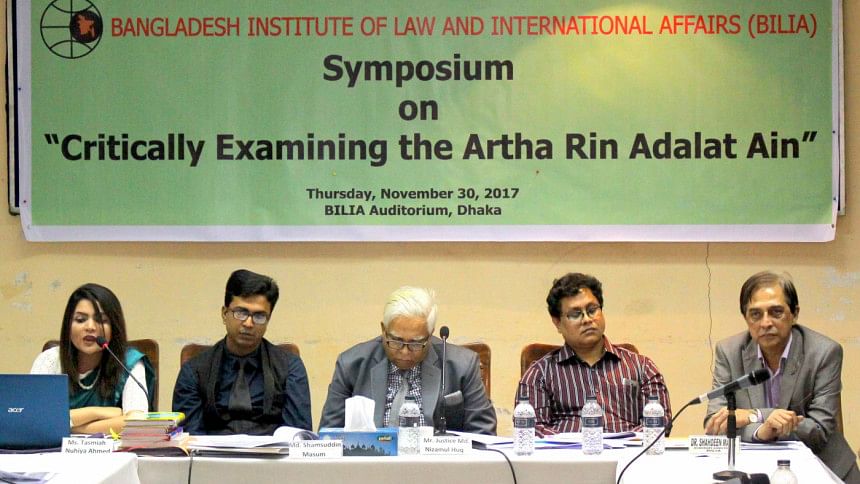

On Thursday, November 30, 2017, Bangladesh Institute of Law and International Affairs (BILIA) organised a symposium titled “Critically Examining the Artha Rin Adalat Ain”to address this perceived unfairness in the law. Papers were presented by Barrister Tapas Kanti Baul, Advocate, Supreme Court of Bangladesh and Prosecutor at the International Crimes Tribunal and Ms. Tasmiah Nuhiya Ahmed, Advocate, Supreme Court of Bangladesh and Research Assistant (Law), BILIA, respectively. Mr. Justice Md. Nizamul Huq, Former Justice of the Appellate Division of the Supreme Court of Bangladesh, presided over the event and Md. Shamsuddin Masum, Judge, Artha Rin Adalat (Dhaka), was also present at the symposium. The welcome address was given by Dr. Shahdeen Malik, Honorary Director of BILIA.

Barrister Baul’s paper was titled “Loopholes in the Artha Rin Adalat Ain: A Third Party Perspective”. He commenced his presentation by recounting the common law maxim that ‘fraud vitiates everything it touches’, which essentially means that even the solemnest of contracts will be void if it were subject to even the slightest degree of fraud. He further expressed his concern about how the innocent third parties are suffering under the provisions of the Artha Rin Adalat Ain due to fraud committed by certain borrowers, he suggested that lawmakers should implement necessary reform, perhaps by including provisions which incorporate mediation, arbitration and restorative justice.

Ms. Ahmed’s paper was titled “Limited Rights of the Borrowers in the Loan Recovery Process under Artha Rin Adalat Ain”. She highlighted that section 19 and Section 41 of the 2003 Act (collectively known as the ‘remedial provisions’) treat the borrowers discriminatorily in comparison to the lenders in a loan recovery process. Ms Ahmed argued that there are good reasons to believe that the restrictions imposed by the remedial provisions ultimately results in a breach of the fundamental rights of the borrowers enshrined under Articles 27 and 31 of the Constitution and runs counter to the kind of ‘socialist society,free from exploitation’ envisioned in the preamble to the Constitution.

Mr. Masum, Judge, Artha Rin Adalat, Dhaka, accepted that the aforementioned provisions of the 2003 Act are indeed quite restrictive for the borrowers. He further added that the Money Loan Courts suffer from an immense case overload as it is and therefore the remedial provisions seek to prevent the borrowers from hindering the loan recovery process by filing frivolous appeals as a dilatory tactic.

Mr. Justice Md. Nizamul Huq took a comparative approach and pointed out that the family law provisions which regulate the recovery of dower money by the wife, do not qualify a husband’s right to appeal by stipulating financial conditions, even though the amount of dower is a debt obligation categorically stated in the marriage documents.

Dr. Malik commented that the favorability of the 2003 Act towards financial institutions is evinced by the largenumbers of banks which have sprawled up in every corner of our cities, since owners of such institutions know that their financial interests are largely protected under the Artha Rin Adalat Ain.

The event is covered by Taqbir Huda, Research Officer at Bangladesh Institute of Law and International Affairs (BILIA).

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments