Forex reserves surge past $19b

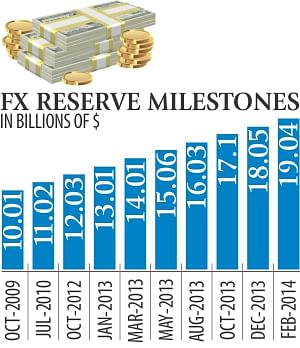

Foreign currency reserves continued its unprecedented growth to reach $19.04 billion yesterday on the back of a rise in remittances and exports and a fall in imports.

This was the first time in the history that the reserves have surged past the $19 billion mark, which placed Bangladesh second only to India in the subcontinent, the central bank said.

"The record rise in reserves shows that the economy is strongly rebounding," Bangladesh Bank Governor Atiur Rahman said.

He said exports have continued to grow and remittance flow is also on the rise despite the slowdown in the initial period of the current fiscal year.

"The reserves might cross $20 billion by June if the current trend continues," he told The Daily Star.

He attributed the strong reserves to a stable exchange rate. "At present, there is no difference between official and unofficial exchange rates. So, more remittances are flowing to the country through official channels."

Zahid Hussain, lead economist at the World Bank's Dhaka office, said there is a huge surplus in the balance of payments, thanks to rising exports and falling imports.

He said the central bank has bought foreign currencies from the local market to prevent the local currency from appreciating, in order to protect the interests of exporters.

The BB said the reserves increased $1 billion just in the last three months. The country added $9 billion to the reserves in the last four and a half years.

“The high reserves also mean the country's credit rating will get a boost. It will be possible to make foreign borrowings at competitive rates, which will help increase investment,” another BB official said.

Despite various crises, both on the local and international fronts, the remittances and exports have been growing continuously, lifting the reserves to a record level.

Export earnings rose 15.04 percent in July-January of the current fiscal year. The country received around $1.61 billion in foreign direct investment in the first 11 months last year, overwhelmingly surpassing the full-year record of 2012 at $1.30 billion.

Remittances saw a growth of 3.29 percent to $1.25 billion in January compared to the previous month.

Opportunities for the private sector to obtain external loans, fall in oil prices on the global market and sluggish imports of rice and luxury items also played a role in the piling up of the reserves.

India held $292 billion in reserves in February, which was $7.1 billion in Sri Lanka in January and $7.59 billion in Pakistan as on February 7.

Pakistan's central bank governor Yaseen Anwar resigned last month, the third to quit the post in four years, weeks after the International Monetary Fund faulted the bank for failing to stem a slide in foreign exchange reserves.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments