Writing off loans a bad practice

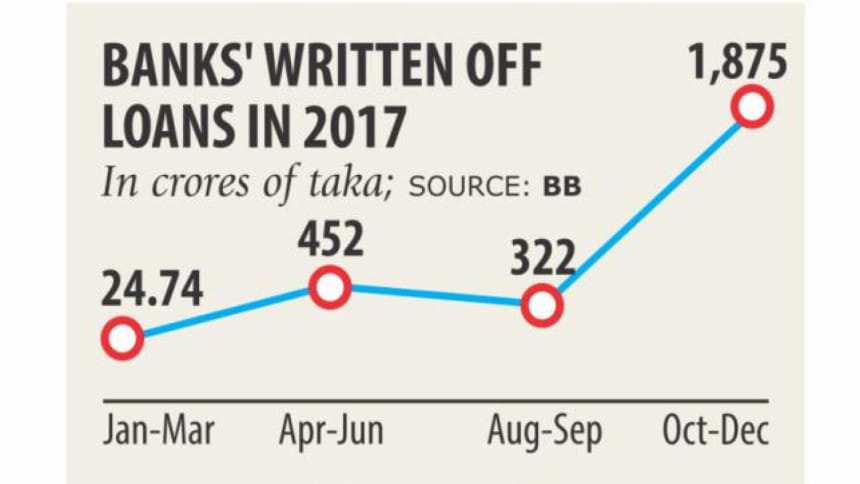

TK 48,192 crore has been written off as irrecoverable loans by state-owned and private banks as of December last year. This state of affairs has come in the backdrop of a failure of banks to effectively pursue legal battles in the effort to recover bad loans. According to central bank regulations, banks are required to file lawsuits in the loan default court, Artha Rin Adalat.

The ballooning of bad loans in the banking sector has been caused due to lack of due diligence in giving loans to parties that have not met eligibility criteria and little has been done to improve matters in that area. While bank balance sheets may look good when bad loans are written off as irrecoverable, the fact is that it is still not known exactly what steps state-owned and private banks have taken to strengthen the mechanisms for loan recovery. We would have thought that such huge sums of loans going bad would have called for a rethink about existing mechanisms and perhaps brought in new ideas as to how to go after defaulters more vigorously.

It appears that the whole idea of dealing with bad loans is to simply reschedule it or write it off. What is unfortunate is that the contagion of scams is increasingly affecting private sector banks too. The time has come to take steps to see how the law may be amended when it comes to dealing with parties who default on loan payments because defaulters simply file writ petitions at the High Court level to put on hold efforts by banks to recover these monies. Simultaneously, the central bank should make it mandatory for banks to strengthen their legal arms to combat the rising scourge of bad loans and not simply write off what is essentially public money.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments