Why this neglect in giving loans to farmers and small entrepreneurs?

It is most unfortunate that the government's stimulus packages declared for small and medium entrepreneurs and farmers last year could not make much of a difference in their economic recovery as those packages were not disbursed properly due to a lacklustre implementation process. Reportedly, many of the banks which were supposed to provide loans to these groups under the stimulus packages showed reluctance in doing so.

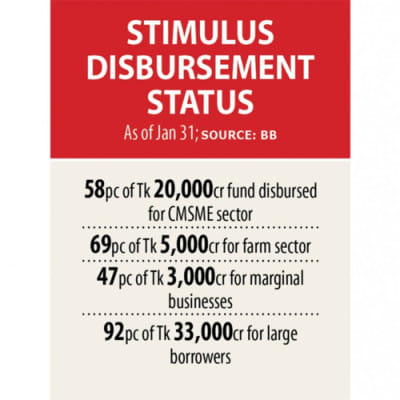

The government declared 23 bailout packages worth Tk 124,053 crore since March 2020 to help various sectors absorb the economic shock of the pandemic. Of the amount, the central bank came up with Tk 87,750 crore in the form of seven packages. For the CMSMEs (cottage, micro, small and medium enterprises), the central bank formed a stimulus package worth Tk 20,000 crore. Although the package was supposed to be implemented by September last year, according to Bangladesh Bank's data, only 58 percent of the fund was disbursed as of January 28. Banks also could not fully disburse the Tk 5,000 crore stimulus package declared for farmers. As of January 2021, 69 percent of the package was distributed among farmers.

Why would the banks not pay heed to the central bank's repeated directives to expedite the disbursement process? Understandably, banks may have fears that they might not be able to recover the loans given to farmers and small and medium enterprises. There were also some issues regarding interest rates which should have been settled beforehand. But whatever might have been the issues, banks should have discussed those with the central bank and come up with a solution rather than showing unwillingness in giving loans. There seems to be a disconnect between the central bank and the commercial banks that needs to be removed. The result of the banks' reluctance is that our agriculture sector and the small businesses are still struggling to recover from the shock of the pandemic. Farmers are suffering the most as they had to cope with not only the impacts of the pandemic but also the aftermath of the devastating floods last year.

Now that the BB has extended the deadline for the disbursement of the stimulus packages till March 2021, we hope banks will comply with its directives. The central bank should also look into the issues faced by the banks and help resolve them. The fund disbursement task should be completed within the new deadline, without any exception.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments