Robi-Airtel merger fee set at Tk 100cr

The finance ministry yesterday finalised the fees for the much awaited Robi-Airtel merger at Tk 100 crore, while the charge for each megahertz of spectrum has been fixed at Tk 33.8 crore for the next four years.

Airtel is currently using 15 MHz of 2G spectrum, and if Robi takes the entire spectrum, it will cost them Tk 507 crore in addition to the merger fee.

The fee was fixed at a meeting of the finance ministry with the telecom division chaired by Finance Minister AMA Muhith, said senior officials present at the meeting.

"This is an acceptable structure and the government believes it will help boost the industry," Tarana Halim, state minister for telecom, said after the meeting.

"We will send the final structure of the fees to the prime minster tomorrow (today) for her approval," Tarana added.

The telecom division had proposed the merger fee at Tk 65 crore but the finance ministry raised it. However, they accepted the telecom division's proposal on spectrum pricing, according to officials.

Robi may take 5MHz or 10MHz of 2G spectrum from Airtel, said a senior official of Robi.

If Robi takes 10MHz, it will have to pay Tk 338 crore for spectrum charge and Tk 100 crore for merger fees.

Robi has not commented on the matter officially.

The two operators opened talks on a possible merger at the end of August last year, and on January 28, the operators' parent companies signed a deal to that effect. If merged, the entity will be the second largest operator in Bangladesh.

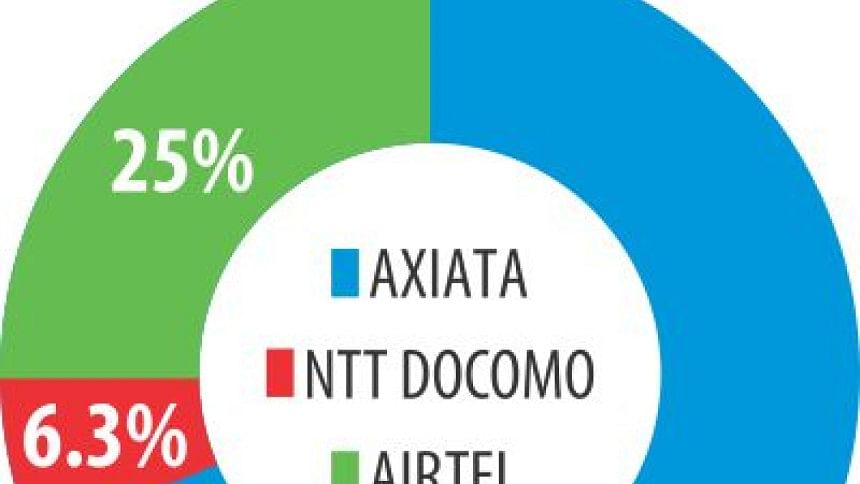

In the merged entity, Axiata, the parent company of Robi, will hold a 68.7 percent stake, Bharti Airtel 25 percent and NTT DoCoMo of Japan 6.3 percent. Currently, Axiata has a 91.59 percent share and NTT DoCoMo 8.41 percent in Robi.

NTT DoCoMo entered the market in June 2008 by taking 30 percent from then Aktel of AK Khan and Company at a price of $350 million. In May 2013, NTT DoCoMo diluted its stake to 8.41 percent from 30 percent, as they lost their interest in investing further.

On the other hand, Airtel entered the market in 2010 by buying a 70 percent share of Warid at an unbelievably low price -- $100,000, which later raised questions; the issue is yet to be resolved. In 2013, Airtel also bought the rest 30 percent share from Warid at a price of $85 million.

As of May, Robi has 2.77 crore active subscribers and Airtel 1.01 crore, making them the third and fourth largest operators in the country in terms of subscription.

Market leader Grameenphone has 5.74 crore active users and Banglalink, which holds the second spot, has 3.22 crore subscribers.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments