Sugar imports become costlier

The National Board of Revenue yesterday imposed a 20 percent regulatory duty on raw and refined sugar imports to safeguard the local mills from the shock of sliding global prices.

The retail prices of sugar are likely to go up from the present level of Tk 38-40 a kilogram due to the move, said industry insiders.

The duty -- effective from today -- has been added to the existing specific customs duty on both raw and refined sugar, which is Tk 2,000 and Tk 4,500 a tonne respectively.

The move comes nearly two months after the revenue authority reversed its plan to hike customs duty on sugar imports in June for fiscal 2015-16 to cushion the local mills from losses due to falling prices in the international market.

Bangladesh Sugar and Food Industries Corporation (BSFIC), which runs 14 state sugar mills, has been demanding duty protection to trim down losses and clear a stockpile of 140,000 tonnes fast.

“It is a good move by the government. We were finding it tough to sell sugar smoothly because of falling prices in the global market,” BSFIC Chairman AKM Delwer Hussain said yesterday.

BSFIC estimated that it incurred losses of Tk 522 crore in fiscal 2014-15, compared to Tk 564 crore in the previous year and Tk 310 crore before that, according to Bangladesh Economic Review.

The latest measure will allow the state-run company to pay wages to workers and buy sugarcane from farmers, he added.

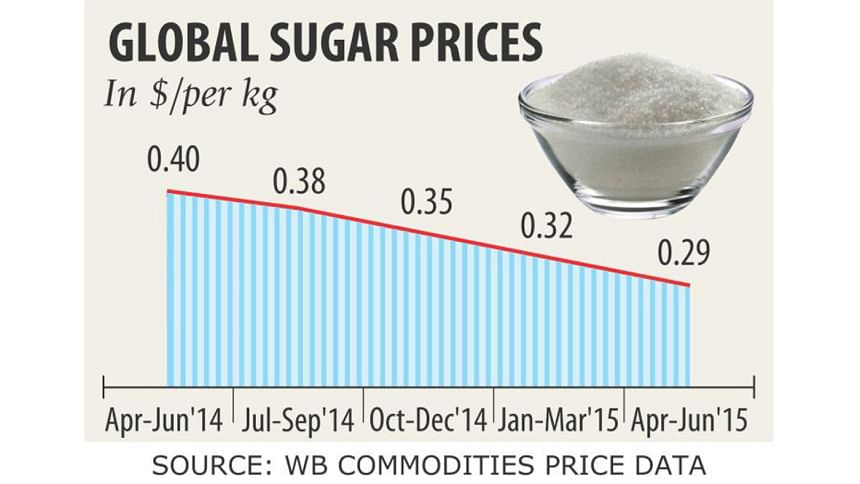

Sugar prices have continued to slide for several quarters now, as supply outpace demand.

World sugar prices fell to $0.29 each kilogram in the April-June quarter from $0.40 year earlier, according to World Bank Commodities Price Data.

As a result, raw sugar can be bought from the global market at about Tk 30,000 each tonne, which is much below BSFIC's production costs, according to Hussain.

At present, BSFIC sells sugar at Tk 37 a kilogram and the private refiners at Tk 33-34.

The present offer price is half of BSFIC's production costs, said its officials.

The BSFIC chairman said the regulatory duty, which is unlikely to create any instability in the market, will enable the government to log in more revenues.

“There will be no crisis of sugar in the market. We have enough stock and we also are going to start production soon,” Hussain said, adding that prices might go up by Tk 4-5 a kilogram.

For duty calculation purpose, the NBR has fixed $320 and $400 per tonne as minimum import prices for raw and refined sugar respectively.

Previously, there was no minimum import price for sugar and duty was calculated based on the import price quoted by refiners and business.

Bangladesh consumes nearly 15 lakh tonnes of sugar annually, 90 percent of which is catered by refining imported raw sugar, according to industry estimates.

Bishwajit Saha, general manager of City Group of Industries that runs the biggest sugar refinery, said the local refineries also incur losses for falling global prices of sugar.

“Our losses are unlikely to be over until BSFIC increases the prices,” he said, adding that the NBR's latest measure means they are unlikely to break-even.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments