Source tax from exports may double next fiscal year

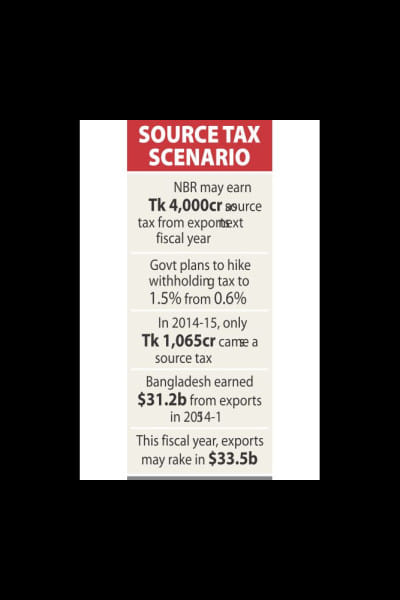

The National Board of Revenue is set to log in about Tk 4,000 crore as source tax from export proceeds next fiscal year owing to the proposed hike in withholding tax rate to 1.5 percent from existing 0.6 percent.

The amount will be double the earnings the tax authority expects in the current fiscal year.

Taxmen said collections from exports are expected to be better this year than the previous year.

In fiscal 2014-15, only Tk 1,065 crore came as source tax, down 49 percent from fiscal 2013-14, according to data from the NBR.

Officials linked the slide in collection to the cut in source tax rate to 0.3 percent for apparel exports in fiscal 2014-15 from 0.8 percent a year earlier.

The source tax rate was 0.6 percent for jute, leather goods and frozen food exports last fiscal year, according to NBR.

“The amount of tax collection from export earning sectors is not encouraging, given the need for increased revenue to finance development expenditure to reduce infrastructure and other deficits,” said a senior NBR official.

Bangladesh earned $31.20 billion from exports in fiscal 2014-15, with garment products accounting for more than 80 percent of the receipts.

This fiscal year, exports are expected to rake in a record sum of $33.5 billion, meaning the taxmen stand to collect Tk 1,500 crore as source tax.

In the first 10 months of the fiscal year, Tk 1,332 crore came as source tax, which has already exceeded last year's total amount.

Taxmen said the tax deducted by banks from export proceeds for apparel items has so far been treated as final settlement for export earners.

Even though their earnings are soaring, many exporters show profits or incomes in line with the amount of tax deducted at source of their exports earnings to avoid having to pay additional tax.

For instance, the corporate tax rate is 35 percent, so if they show reduced income their corporate tax amount shrinks too.

“So, what we collect as source tax from export proceeds is actually the total amount of tax that we get from the export-oriented sectors -- the amount should be much higher.”

On the flipside, exporters face problems in investing their legally earned money for having shown lesser income on paper.

“As a result, a large amount of their legally earned income turns illegal and they cannot officially show the income,” the official added.

Exporters are opposing the increased source tax rate for next fiscal year on the ground that it would increase their costs of production and thereby make them non-competitive in the global market.

The Metropolitan Chamber of Commerce and Industry recently demanded continuation of the 0.6 percent source tax on the value of export consignment for next fiscal year.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments