Revenue rises 16pc in July-March

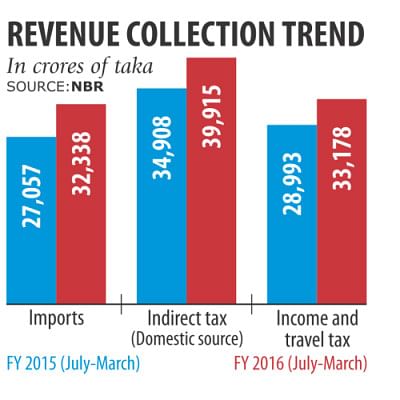

Revenue collection rose 16 percent year-on-year to Tk 105,432 crore in July-March of the current fiscal year, spurred by higher exports, imports and income tax, according to preliminary data of the National Board of Revenue.

The amount is 70 percent of the revised target at Tk 150,000 crore for this fiscal year, meaning the NBR will have to collect Tk 44,568 crore in the remaining three months.

The tax authority is optimistic about reaching the revised target, which is 15 percent lower than the original target of Tk 176,370 crore.

“We will have an impressive collection figure after we finish realising the dues,” NBR Chairman Md Nojibur Rahman said.

The tax authority earlier said it was working to realise arrears of Tk 23,000 crore in taxes from various state organisations.

However, growth of tax receipts slowed in March from the same month last year, particularly for a decline in VAT collection from domestic sources.

In March, collection from external trade-related activities soared 27 percent to Tk 4,074 crore year-on-year. Overall, receipts grew about 20 percent to Tk 32,338 crore in July-March, owing to increased exports and imports after a downturn in the initial months of the fiscal year.

Imports rose 6.48 percent in the eight months to February compared to the same period last fiscal year, while exports maintained 9 percent growth in July-March.

At the domestic front, income tax collection improved a bit in March.

Income tax receipts rose nearly 15 percent year-on-year to Tk 32,495 crore in July-March.

“An increased flow of advance tax from large taxpayers, especially corporate firms, has played an important role in improving the tax collection scenario,” said a senior tax official, seeking anonymity.

However, indirect taxes from domestic businesses slowed. In March, collection of indirect taxes and VAT dropped 5 percent to Tk 2,816 crore year-on-year, according to the NBR. The revenue official blamed the sluggish flow of VAT on a slowdown in real estate and construction sector activities.

Towfiqul Islam Khan, a research fellow at the Centre for Policy Dialogue, said a slowdown in income tax collection and decline in VAT collected at the domestic stage are not encouraging signs.

The NBR will need to emphasise the due revenues, particularly from state-owned enterprises, he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments