Raising private investment a major challenge: MCCI

Accelerating private sector investment is a major challenge for Bangladesh to achieve the 7 percent economic growth target in the current fiscal year, a leading chamber said.

Political stability also remains a hurdle to maintaining macroeconomic stability that is vital to achieving higher growth, said Metropolitan Chamber of Commerce and Industry in its quarterly economic review released yesterday.

“Presently, the investment rate is much below the target of 35 percent of GDP that is required for achieving the 7 percent growth,” the chamber said in its review for October-December.

MCCI said the business climate must be improved substantially, as local and foreign investors usually consider three things before going for investment in any country -- political stability, easy availability of reasonably priced utilities and infrastructure, and easy access to bank loans at low interest rates.

The net foreign direct investment in July-November this fiscal year increased 6.88 percent to $730 million from $683 million in the same period in the previous fiscal year, said the chamber.

The investment is not enough for the country's development. “Investors are yet to get back confidence. The prospective foreign investors have adopted a 'go-slow' strategy in making fresh investments since 2013,” it said.

Investors think major impediments to new investment include poor infrastructure, a shortage of power and energy, a lack of consistency in policy matters, weak regulatory framework, a scarcity of industrial lands, and political uncertainty.

“The government needs to address these impediments to attract more FDI in line with its target of graduating to a middle-income country by 2021,” the MCCI said.

The chamber, however, found the overall economic situation positive as shown by steady improvements in major economic indicators. “Although the progress made is below potential, the country experienced stable growth, inflation was under control, the exchange rate remained stable, and foreign exchange reserves rose and remained at a comfortable level.”

The agriculture sector performed well, but continuous government support with inputs and finance will be needed to sustain the sector's growth. “Infrastructure deficits and gas and power supply problems were undermining the performance of the manufacturing as well as the agriculture sector.”

The government will, therefore, need to adopt suitable measures to remove these bottlenecks to support the growth of these two important sectors, said the chamber.

The services sector is doing well but it will also need government support in respective areas. Most importantly, political harmony should be maintained to achieve the government's growth and inflation targets, MCCI said.

Adequate infrastructure, energy, policy continuity, skilled manpower, political stability and investment-friendly climate are the key factors for higher economic growth.”

Despite the weak external impetus because of the recession in the Euro area, Bangladesh has maintained a stable economic growth rate of more than 6 percent in the last few years. “However, in order to keep the growth momentum up, the government will need to raise enough resources to meet the heavy pressure on the budget caused by the salary hike for government employees and essential spending on physical infrastructure.”

The chamber said the rate of inflation may fall further in January-February because of a decline in commodity and fuel prices in global markets.

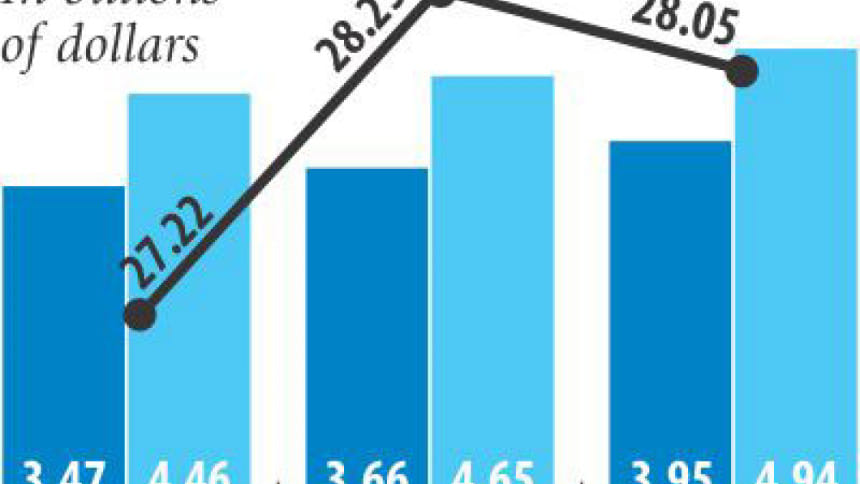

The MCCI assumed that the relatively calm political situation at present will continue in the third quarter of this fiscal year. “Therefore, export, import, and remittance will increase further.

Foreign exchange reserve can be expected to fall in January and March due to payment to the Asian Clearing Union against imports,” it said.

On the capital market, the chamber said the market has passed yet another gloomy year as trading activities were dull almost throughout 2015. “Various efforts taken by the government and regulators to shore up the market in the past five years virtually failed to bring desired results.”

Foreign investment in the stockmarket witnessed a 92.94 percent decline year-on-year in 2015, driven by profit booking sales by overseas investors, MCCI said.

Broad money recorded a higher growth of 13.81 percent year-on-year at the end of November, compared to 12.84 percent a year ago. Domestic credit, on the other hand, recorded 10.31 percent growth at the end of November, which was 10.85 percent a year ago.

The government achieved commendable success in short-term action for power sector crisis management, but the long-term goals remain unresolved, MCCI said. “The power supply situation, however, improved in the quarter under review, but demand for power, too, shot up.”

As of December, total generation was 5,039MW during day peak hours and 6,553MW during evening peak hours; maximum generation in 2015 was 8,177MW on August 13, 2015.

The chamber said manufacturing activities showed signs of regaining momentum, thanks to a calm political situation.

Bangladesh's economy is progressing well, but below its true potential, MCCI said. “The government's efforts should be intensified to overcome the impediments.”

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments