Rush for family savings tools

The downing of bank deposit rates is pushing savers towards national savings certificates as they seek higher returns after incomes were wiped out by the coronavirus pandemic.

And on the frontline are families with investable funds.

Sales of family savings instruments grew nearly threefold year-on-year to Tk 20,149 crore in the July-December period of fiscal 2020-21 from Tk 7,581 crore.

Many of the investors bought such certificates in the names of their spouses and children.

Overall sales of savings certificates soared 60 per cent year-on-year to Tk 54,976 crore in the first half of the fiscal year.

The driving factor was the more than 11 per cent interest offered by the government on various savings certificates, including that for families. The interest rate of family saving certificates is the highest, at 11.52 per cent.

One can buy Tk 45 lakh-worth of the instrument using a single account. The sale of the certificates through joint accounts is not allowed.

The sale of savings certificates for a three-month term also increased because of a higher ceiling for quantities bought and an opportunity to purchase it for the underaged.

The instrument's sales soared 151 per cent year-on-year to Tk 15,059 crore from July to December. The interest rate for the certificates is 11.04 per cent. One can buy Tk 30 lakh-worth of the certificates and double that using joint accounts.

The sale of savings certificates had increased even during the Covid-19 pandemic, which wiped out the incomes of many families.

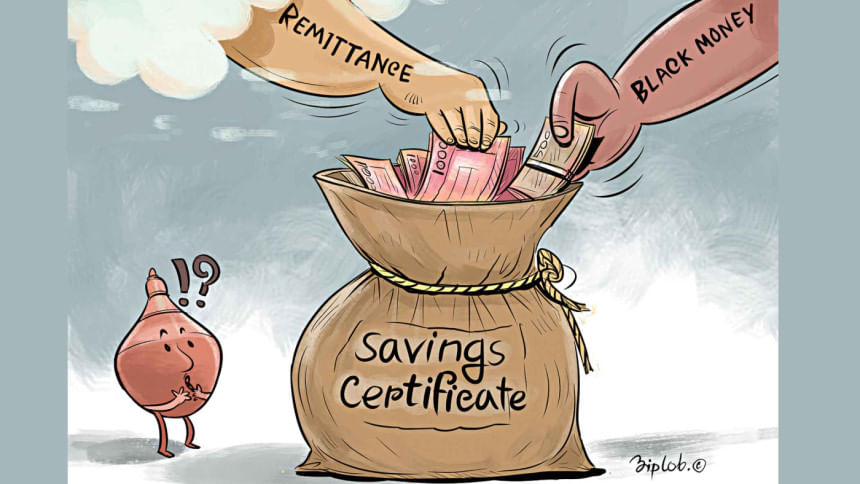

Analysts attribute the spiral to an opportunity to whiten black money on payment of a 10 per cent tax on the declared amount and the increased inflow of remittance from the Bangladeshi expatriates.

Zahid Hussain, a former lead economist of the World Bank's Dhaka office, said the net sales of national saving certificates had already exceeded the budget target for FY21.

There has been a boom in the sales despite a decline in incomes and savings due to Covid-19 and tighter enforcement of eligibility for investment by the government since last year, he said.

"The biggest reason perhaps is the surge in remittances, which went into the purchase of family saving certificates."

Repatriated savings from the returnee migrant workers may have been invested in these certificates, in addition to those remittances diverted from informal to formal channels, said Hussain.

As the sales of savings instruments soared, the government fixed the maximum limits for purchases under individual and joint names.

According to a notification of the Internal Resources Division, a person can't invest more than Tk 50 lakh in three savings instruments.

The three are the five-year Bangladesh savings certificate, the three-month profit-bearing savings certificate, and the family savings certificate.

Under joint names, the highest amount of investment in the three savings schemes can be Tk 1 crore, apparently an attempt at discouraging wealthy people from putting in too much money in savings instruments.

The interest rates on bank deposits have declined significantly. The resultant large difference has dulled the attractiveness of term deposits and increased that of national savings certificates.

The weighted average interest rate on bank deposits dropped to 4.54 per cent in December from 4.64 per cent a month ago, Bangladesh Bank data showed.

The current interest rate is lower than the inflation rate.

"Some investments may also have come from the whitening of undeclared money since the scope of using the untaxed money without asking any questions has been widened this year," said Hussain.

"As a result, there has been a significant rise in the disclosure of previously undeclared income," he said.

Some Tk 10,222 crore was whitened between July and December.

The opportunity to whiten the black money reduced the amount of money deposited in banks for the lower interest rates.

There has been a significant inflow of remittance. It was $12.95 billion in the July-December period.

The sales of five-year savings certificates increased by 25.20 per cent to Tk 4,977 crore.

The interest rate of the instrument is 11.28 per cent. One can buy Tk 30 lakh-worth of the certificates and Tk 60 lakh-worth through joint accounts.

Anyone can buy the savings certificate, including those earning from businesses involving agriculture and fisheries, after obtaining permission from the tax commissioner.

The sale of postal savings certificates decreased by 24.93 per cent to Tk 8,802 crore between July and December because of a reduction in the purchase limit.

One person can buy Tk 10 lakh-worth of term postal savings certificates and Tk 20 lakh-worth through joint accounts.

Ahsan H Mansur, executive director of the Policy Research Institute, said people were not interested in depositing money in banks because of the lower interest rate.

For instance, banks previously used to pay 6 to 7 per cent interest. Now the rate has declined to 3 to 4 per cent.

Moreover, the government's capping of the purchase of the saving instruments did not work well, Mansur said.

Although the government set ceilings, there has been no compliance as it was possible to buy the certificates under the names of other family members such as wife and children, he said.

Currently, there is liquidity in the market. So, people are investing money in the savings instruments rather than depositing them in banks, said the former official of the International Monetary Fund.

"Such a situation is not helping the development of a bond market in Bangladesh. Most of the bonds have remained non-traded for years. As a result, such a move is not at all good for the economy."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments