Record Tk 10,220cr black money legalised in Jul-Dec

Black money-holders legalised the highest amount of undeclared assets in history in just six months of the current fiscal year as no government agency now raises questions about some sources of incomes due to a waiver announced in the budget.

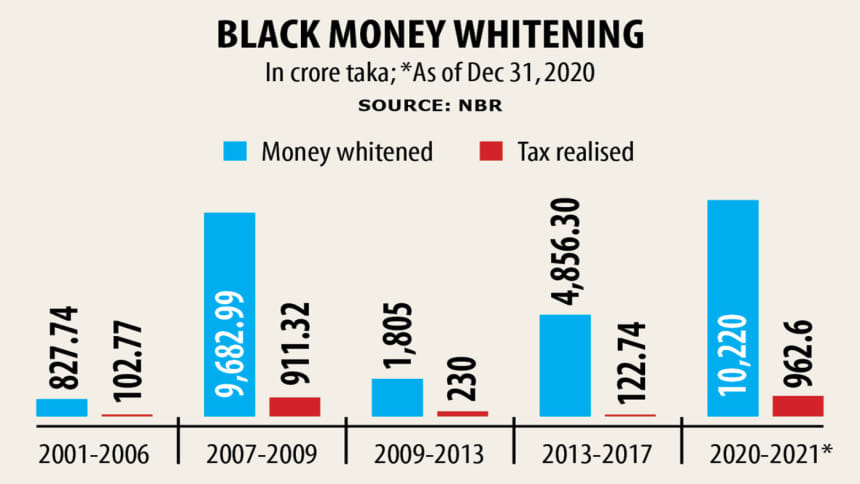

A whopping Tk 10,220 crore entered the formal economy in the first half of the current fiscal year after many untaxed money-holders whitened their assets by paying taxes, the National Board of Revenue (NBR) said in a press release yesterday.

"This will particularly help attract investment, create jobs and raise tax-to-GDP ratio."

Some 205 taxpayers invested their undisclosed money in the securities approved by the Bangladesh Securities and Exchange Commission after paying a combined tax of Tk 22.84 crore during the July to December period.

Another 7,445 taxpayers legalised assets by paying a total tax of Tk 939.76 crore.

The previous highest was recorded in fiscal years 2007-08 and 2008-09 during the regime of the Army-backed caretaker government. At that time Tk 9,682.99 crore was legalised, the NBR data showed.

In the current fiscal year, the government has allowed the wholesale opportunity to legalise black money to accelerate the economy's growth, increase investment, and develop the stock market as previous attempts did not pay off.

"The taxpayers gave an unprecedented response," the NBR said.

The opportunity to legalise black money will continue until June 30 this year.

The government wants to generate an increased amount of revenue from the legalisation of untaxed money as it needs funds to kickstart the pandemic-ravaged economy.

The government has introduced the provision that no authority, including the NBR and the Anti-Corruption Commission, can raise any question on such declarations.

Now, individual taxpayers will be allowed to disclose any undisclosed home property, including land, building and flat, by paying tax at a particular rate per square metre.

Individual taxpayers can disclose undisclosed cash, bank deposits, savings certificates, shares, bonds or any other securities on paying taxes at a rate of 10 per cent.

They can also invest in the capital market and show it in their tax returns. They have to maintain a lock-in period for a year.

Black money is largely attributed to tax evasion, and its direct impact is the loss of government revenue.

Undisclosed, unreported, untaxed economic activities, wealth and money are the major components of the underground economy in Bangladesh, according to a government analysis in 2011.

Undisclosed money and wealth are kept in different forms and shapes in Bangladesh. Some of the forms are bank accounts, real estates, stocks and shares, savings instruments, investment in a foreign country; cash, golds, jewellery and under-valued assets.

The larger chunk of black money is transferred abroad, and only a little goes into the fixed deposits, while the black money owners spend the rest on maintaining a posh lifestyle, the analysis said.

The government has set an income tax collection target of Tk 105,475 crore in the current fiscal year.

About 2409,357 income taxpayers submitted income tax returns by the deadline of December 31, up 9 per cent compared to that a year ago.

Income tax receipts stood at Tk 34,238 crore, which was Tk 1,545.09 crore higher than in the same period last fiscal year, the press release said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments