Pandemic may trigger corporate, household debt defaults

The economic crisis stemming from the fallouts of the coronavirus pandemic is likely to trigger a series of corporate and household debt defaults, said Mahbubur Rahman, president of the International Chamber of Commerce Bangladesh, yesterday.

Bangladesh has recorded one of the world's fastest growth rates in the past few years with a stable economic performance, reducing poverty and social inequalities, he told a virtual 25th annual council of the chamber's executive board.

Quoting a recent International Labour Organisation (ILO) report, Rahman said Bangladesh was now faced with battling both the pandemic and its economic fallouts.

In such a situation, economic risks are not only limited to the short term but also extend to major future productivity losses both through labour and capital, according to a press release from the chamber.

Like most other emerging economies, Bangladesh has to reach a number of key targets to achieve the desired GDP growth, which include that in healthcare, export, foreign direct investment (FDI) and remittance.

In Bangladesh, there are around 7.8 million enterprises and 90 per cent of them are micro-enterprises.

The cottage, micro, small and medium enterprise sector contributes 25 per cent to the GDP, amounting to around $79 billion. This sector accounts for 30 per cent of the country's total employment as well, said Rahman.

The high cost of doing business is affecting these firms. Besides, many have been suffering tremendous setbacks in terms of production, marketing and sales, he said.

Bangladesh's status graduation from a least developed to a developing country by 2024 will lead to the loss of preferences, including those in trade with major export destinations. So, the country must focus on reaching free trade agreements (FTAs) with major trading countries, Rahman added.

Mentioning the executive board report, the chamber's statement also said the second wave of Covid-19 was already sweeping through Europe and the US which would further prolong the economic downturn.

Like most other emerging economies, Bangladesh will also be affected and will have to tackle the desired GDP growth issues, which include saving the small-scale firms, getting expatriate workers back to their workplaces to maintain remittance inflow and attracting more FDI.

Saving the small-scale enterprises is very important to maintain sustainable growth, keep supply chains functional and stay cost-effective, it said.

The pandemic created a massive economic contraction that will be followed by a financial crisis in many parts of the globe, as nonperforming corporate loans accumulate alongside bankruptcies.

Sovereign defaults in the developing world are also poised to spike. This crisis will follow a path similar to the last crisis and the crisis will hit lower-income households and countries harder than their wealthier counterparts, the report observed.

The G20, along with the WHO, the International Monetary Fund, the World Bank Group, United Nations and other international organisations, are mobilised to take active steps to overcome the pandemic, and the International Chamber of Commerce (ICC) is collaborating as a trusted business adviser.

The report mentioned that as part of this campaign, the ICC has released a call to action encouraging governments to ensure that stimulus efforts flow rapidly into the real economy and provide direct and immediate support to the small firms and their workers to ensure their continued operation.

Given the cross-border nature of supply chains, such stimulus and safeguard measures should be taken in a coordinated manner at both the national and international levels.

Countries around the world are implementing economic and fiscal measures, including emergency tax measures to support their economies under the Covid-19 pandemic.

In this respect, the ICC has highlighted a number of key tax measures that governments could take to save the small-scale firms and relieve cash flow stress.

The council approved the auditor's report of 2019 and appointed the auditor for 2020, the ICC Bangladesh also said.

The annual council paid tribute to Latfiur Rahman, founding member and vice-president of the ICC Bangladesh, Waliur Rahman Bhuiyan, a former executive board member, Barrister Rafique-Ul Huq, Niloufer Manzur, wife of Apex Group Chairman Syed Manzur Elahi, and national professors Jamilur Reza Choudhury and Anisuzzaman.

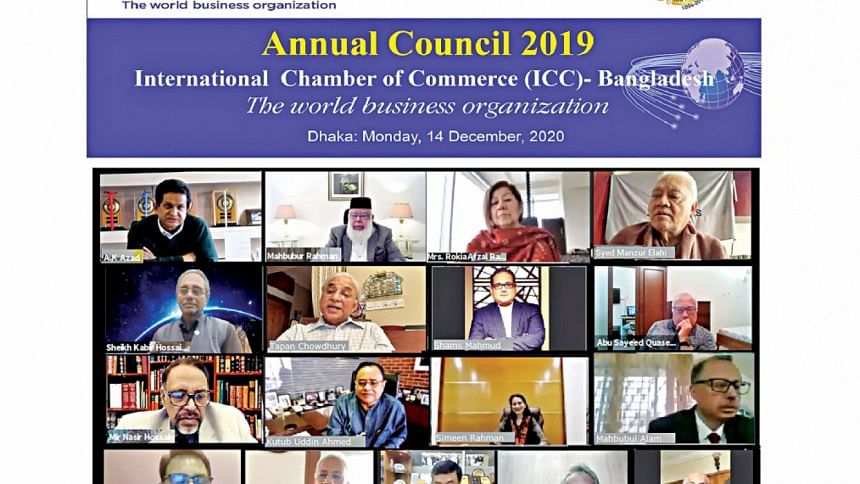

The council was attended by ICCB Vice President Rokia A Rahman, Syed Manzur Elahi, Dhaka Chamber of Commerce and Industry President Shams Mahmud, Chattogram Chamber of Commerce and Industry President Mahbubul Alam, Bangladesh Insurance Association President Sheikh Kabir Hossain, and Nordic Chamber of Commerce and Industry in Bangladesh President Tareq Rahman.

ICCB executive board members ASM Quasem, Aftab ul Islam, AK Azad, Abdul Hai Sarker, Md Fazlul Hoque, Kutubuddin Ahmed, Mir Nasir Hossain, Mohammad Hatem, Simeen Rahman and Tapan Chowdhury were also present.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments