Insurers rake in aided by cut in agent commission

Insurance companies made higher profits in the January-September period despite the coronavirus pandemic aided by the lowering of the commissions they offer to agents to secure businesses.

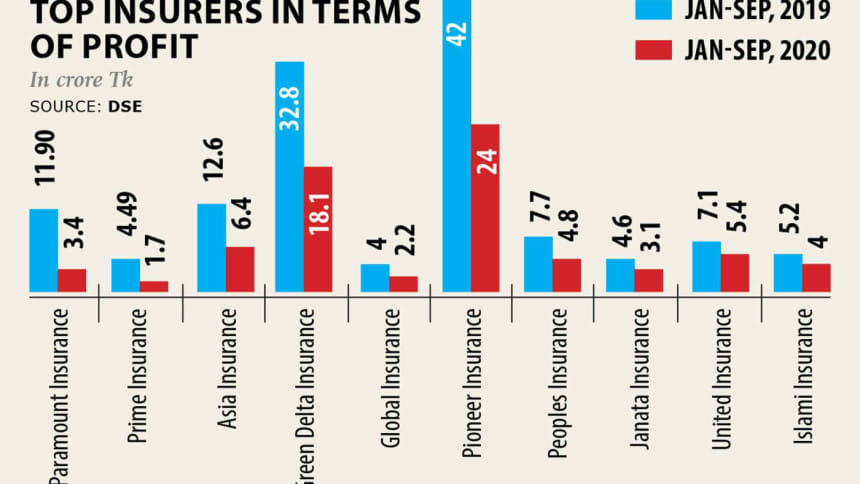

There are 48 insurers listed with the Dhaka Stock Exchange (DSE), of which 36 have published financial reports. Among the 36, 28 witnessed higher profits and the rest lower in the last nine months.

"The regulatory step lowering agents' commission to 15 per cent was the main reason behind the boost in profits this year. All companies have benefitted," said Zharna Parul, company secretary of Paramount Insurance.

In 2012, the Insurance Development and Regulatory Authority issued a circular barring insurance companies from paying more than 15 per cent of the premium as commission to their agents.

However, most insurers disregarded the directive, prompting the regulator to issue a notice in late 2019 instructing them to comply for the sake of the sector's welfare.

Subsequently, in a meeting with Bangladesh Insurance Association last year, insurance companies collectively agreed to follow the order in a bid to keep the sector alive.

Many companies offered as high as 60 per cent of the premium as commission to secure business, which hurt profits of the insurers, according to industry insiders.

Profits of Paramount Insurance rose 243 per cent to Tk 11.96 crore in the past nine months, the highest among the listed insurance companies.

"If the pandemic had not hit in the year, our profits would have been much higher," said Parul.

Insurance companies made profits from the stock market too in the year as the index of the market was bullish in the third quarter, she added.

The DSEX, the DSE's benchmark index, rose 28 per cent, or 1,130 points, in the July-September period. It dropped 8.1 per cent, or 436 points, in the same period of the previous year.

Thanks to the buoyancy in profits, stock investors were lured into buying the stocks of the insurers, said a merchant banker.

All insurance stocks rose in the last six months, and many even doubled. The sector topped the top turnover list in the previous three months, DSE data showed.

Speculation about the sector also fueled the stock price, the merchant banker said, adding that many stocks sold at overvalued prices.

Analysts knew that the earnings of the insurance companies would rise, but that does not back up the rise in prices, he said, adding that the pandemic would hit the sector in the upcoming quarters.

Profits of Prime Insurance rose 150 per cent to Tk 4.47 crore in the nine months. Asia Insurance, Green Delta Insurance, Global Insurance and Pioneer Insurance also took home higher profits.

The insurance sector has significant prospects as its penetration is still very low compared to that in neighbouring countries and the government has plans to enhance the penetration, said stock investor Abdul Haque.

"As the Bangladesh economy is walking towards turning into a developed economy, the insurance sector will become much bigger in the near future," he said.

Insurance penetration (insurance premium as a fraction of the GDP) in Bangladesh was only 0.57 per cent in 2018 and has been decreasing since 2009.

The life insurance penetration rate in Bangladesh was only 0.41 per cent while that in Vietnam and India was 1.58 per cent and 2.74 per cent respectively in 2018.

Indeed, the recent stock price hike of the insurance sector was mainly due to the role played by speculators, Haque said, adding that investors need to be cautious so that they do not end up buying overpriced stocks.

"Now most of the insurance stocks are overpriced," said an asset manager, preferring anonymity.

Though the companies have potential to grow, it will take a considerable amount of time because the sector has been struggling to win public confidence, he said, adding that it would also see the impact of the pandemic.

So, a rise in stocks can be termed normal to some extent but not as much as doubling or tripling in prices, he said.

Stocks of Asia Insurance jumped 500 per cent to Tk 120 during the last six months. Almost the same pace was witnessed in case of some other stocks as well, DSE data showed.

"If the insurance companies can make profits to such high extents at the end of the year, investors will find it reliable. Otherwise, it would seem that the profit showed higher for speculation in share prices," said an asset manager.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments