Improve infrastructure, business climate to remain competitive

Development of physical infrastructure, improvement of the business climate and labour productivity and technological adoption are the key to making Bangladesh competitive in global trade by offsetting the fallouts of the LDC graduation.

"Improved infrastructure and labour productivity will reduce the costs and smoothen the business in the post-LDC period," the General Economics Division (GED) said in a study report.

The wing of the planning ministry carried out the study styled "Impact assessment and coping up strategies of graduation from LDC status for Bangladesh" as the country is set to graduate from the group of the least developed countries in 2024.

It said although the government must be lauded for increasing the number of power plants to 108 in 2020 from 27 in 2009, most of them are small scale.

Keeping in mind the rise of projected demand for electricity to 34,000 MW by 2030, the government is planning to invest around $70 billion in the power sector over the next 15 years.

"It is important that this investment is based on using least-cost options and renewable energy to the extent technically possible to lower the cost of electricity, ensure the sustainability of primary energy supply and reduce carbon pollution.

"Proper pricing of primary energy will be of critical importance."

Emphasis will also have to be given to power transmission and distribution, upgrading of grid capacities, and energy trade in the region.

Cooperation with neighbouring countries such as India in the field of energy trade is ongoing, and this should be broadened to include Bhutan and Nepal, the report said.

The GED report said the current road network was inadequate to provide infrastructural support to a country with a population of more than 160 million and that is aspiring to become a high-income country in 2041.

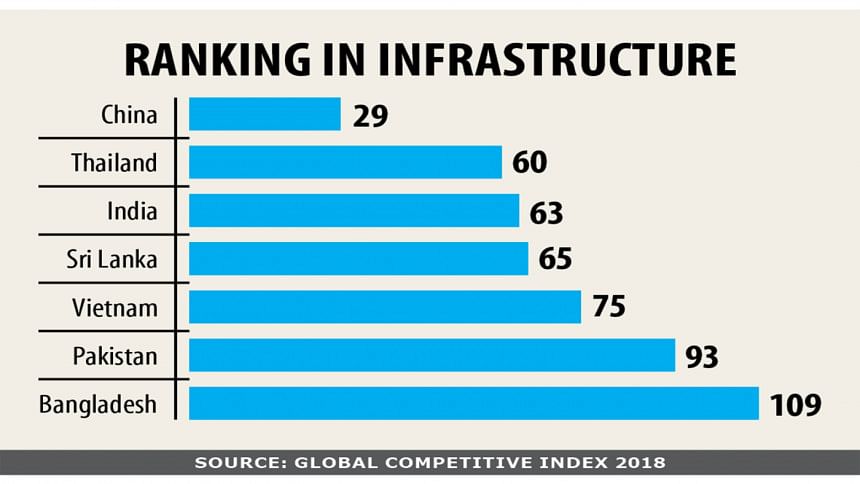

In global connectivity, Bangladesh is given a score of 34.3 out of 100 and a ranking of 121th out of 140 countries. The quality of roads is also considered to be below average, with a score of 3.1 out of 7 and a rank of 111th out of 140.

"Export competitiveness can be adversely affected by the high cost of trading, both for imports of raw materials and capital goods and exports of products."

The importance of efficient, low-cost trade logistics is now well-recognised as an essential determinant of export competitiveness.

Bangladesh is ranked 100th out of 160 countries in the Index of Trade Logistics Performance (LPI) of the WB, much behind China, Thailand, India and Vietnam.

China, India and Vietnam are major competitors of Bangladesh for garment in the European Union, and the higher cost of trade logistics may have serious adverse consequences for maintaining market share post-LDC graduation, the report said.

Once Bangladesh graduates from the LDC group, the competitiveness challenge will intensify.

"In order to maintain the market share in the more competitive environment, it will be vital for firms to have timely and less costly access to raw materials, maintain production schedules and ship products to their buyers on time."

Ship turnaround time and cargo clearance from container yards at the Chattogram port, which handles 75 per cent of Bangladesh's $90-billion international trade, are longer than the most ports in the region. Reforms should be done to improve the efficiency of the Mongla port.

Additionally, after holding dialogue with all stakeholders, decisions should be taken as to whether some of the handling operations in the ports of Chittagong and Mongla should be contracted out to private entities, the report said.

Despite progress with the policy environment for the private sector that has spurred the expansion of private investment from a low of 6 per cent of GDP in the fiscal year of 1988-89 to 23 per cent of GDP in FY2018, the overall investment climate for Bangladesh remains substantially weaker than those found in competing countries.

This is reflected in the global rankings of investment climate prepared by the WB as well as by the World Economic Forum. The WB 2020 Ease of Doing Business ranks Bangladesh 168th out of 190 countries.

Bangladesh has taken some positive steps to address the serviced land constraint through industrial parks and special economic zones.

"This is a welcome move. Speedy completion of all ongoing facilities and making them available on a timely and business-friendly way will be an important factor to spur domestic and foreign investment," the GED report said.

"Bangladesh should focus on reducing the time it takes to get electricity, register property, obtain credit, trade across borders, enforce contracts and resolve insolvencies."

Export expansion and diversification are often constrained by limited domestic capital, technology and market knowledge.

The foreign direct investment (FDI) with their better technological and managerial skills and knowledge about international marketing conditions is expected to improve the productivity and export performance of host country firms.

It has been argued that Bangladesh needs to get on the bandwagon of the global value chain (GVC) as a means to export-oriented industrialisation.

Cross-border FDI flows have been the lifeline for the growth of GVC trade that helps sustain the growing production networks across borders.

Bangladesh's record in mobilising FDI is disappointing, the GED said.

FDI in Bangladesh reached $2.2 billion in 2017, as compared with $134 billion in China, $40 billion in India and $14 billion in Vietnam.

Currently, Bangladesh faces the dual challenge of mobilising more FDI and integrating into the GVC operation.

Its best chance of getting on the GVC bandwagon lies in aggressively courting FDI from multinationals that are seeking low-cost locations for producing parts and components or for final assembly within the framework of cross-border production integration.

FDI thus becomes critical for Bangladesh not only to develop a wider base of intermediate goods industry but also to diversify exports into intermediate goods by vertically integrating with cross-border production entities.

Bangladesh needs to translate its RMG experience with GVC on to other sectors such as footwear and leather goods, electronics, light engineering, toys, and plastics with an aggressive strategy of FDI-driven GVC over the course of the next decade, the report said.

"That would constitute a new form of export-oriented industrialisation for Bangladesh on way to graduating out of LDC status and becoming an upper middle-income-country."

Bangladesh is abundantly endowed with low-cost labour that provides the basis for comparative advantage in producing and exporting labour-intensive products.

Indeed, the RMG revolution is a prime example of how Bangladesh gained global market share based on low labour cost. Yet, it is also recognised that labour productivity in Bangladesh is very low.

"A major challenge in the post-graduation world for Bangladesh would be to increase labour productivity through large investments in human capital and other policy changes. This perhaps holds the key to successful graduation from LDC status."

Using land, employing labour and investing capital away from agriculture to industry is not enough if the labour force is not trained and productive.

Bangladesh has made important inroads in improving human capital as suggested by favourable human development indicators relative to comparators at the same level of development.

Major gains have been made in both health and education front. Yet, the 2016-17 labour force survey shows that 32 per cent of the labour force did not have any education, 26 per cent had only primary education, 31 per cent had secondary education, and 12 per cent had higher secondary and tertiary education.

The quality of labour force in terms of skills is also low on average although the government undertook the National Skills Development Policy in order to increase the capabilities through spreading the extent of technical and vocational education and training.

Building on the progress achieved in basic education and strengthening of other levels of education, including vocational and higher education are important to have a well-educated and skilled population with the capacity to contribute effectively to the country's development.

"In addition to reducing red tape, lowering tariff barriers and the time spent while complying with different procedures to set up businesses, it is also important to have a competent and well-organised customs service to make Bangladesh competitive in the world market."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments