FDI edges down for first time in 7 years

Foreign direct investment to Bangladesh dropped last fiscal year, the first decline in seven years, because of the pandemic-induced slowdown in business and regulatory barriers.

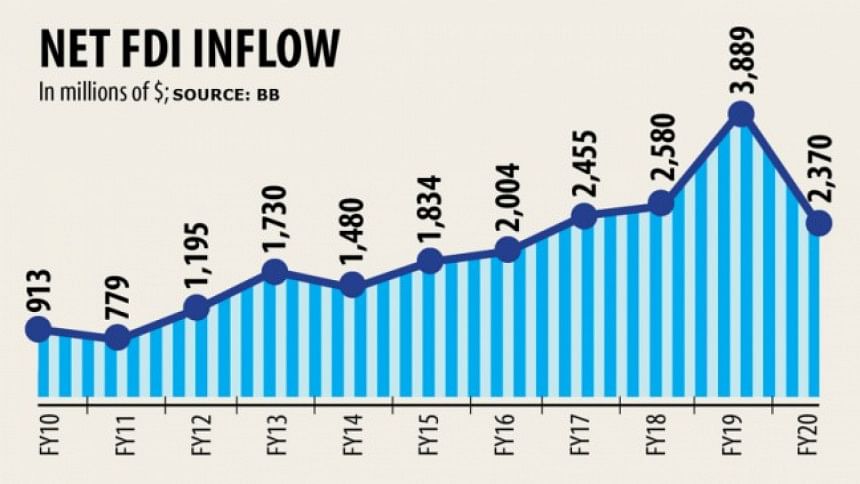

Net FDI nosedived 39 per cent year-on-year to $2.37 billion last fiscal year, data from the central bank showed.

The about-face in the FDI came just a year after it surged to its highest on record, riding mainly on Japan Tobacco Inc's acquisition of Akij Group's tobacco business for $1.47 billion. In 2018-19, net FDI stood at $3.88 billion.

Although the financial meltdown caused by the coronavirus pandemic has taken a toll on the FDI flow, the whole situation should not be judged by the ongoing economic hardship alone, analysts say.

"FDI flow across the globe has declined in recent periods due to the financial crisis, which started in March," said Mustafizur Rahman, a distinguished fellow of the Centre for Policy Dialogue.

Global FDI flows are forecast to decrease by up to 40 per cent in 2020, from their 2019 value of $1.54 trillion, according to the World Investment Report 2020 of the United Nations Conference on Trade and Development (UNCTAD) released in June.

This will bring the global FDI below $1 trillion for the first time since 2005.

In March, the International Monetary Fund said that investors had withdrawn $83 billion from developing countries since the beginning of the Covid-19 crisis, the largest capital outflow ever recorded.

"Along with the latest economic slowdown, Bangladesh has been struggling to attract desired FDI for years because of red tape," Rahman said.

The government had targeted to attract FDI to the tune of $32 billion under the seventh five-year plan stretching from FY16 to FY20.

"But the country managed to attract less than $10 billion, which is frustrating beyond a doubt," he said.

"This means there have been many other issues along with the pandemic for the sharp decline in FDI last fiscal year."

The government is still far from resolving the dispute settlement mechanism, implementing one-stop services, and providing required logistics and trade facilitation to foreign investors, according to the economist.

Poor services have been discouraging foreign investors for years to make Bangladesh as their investment destination, he said, adding that the barriers should be resolved promptly.

FDI in the field of equity capital declined 39 per cent year-on-year to $728 million, Bangladesh Bank data showed.

"The regulatory environment in Bangladesh is weaker than in peer countries, and it is emerging as a major roadblock to attracting equity capital," said Mamun Rashid, an investment analyst.

Some unnecessary regulations have also created complexity to make a smooth investment in the country as well, he said.

Restrictions on movement across the globe to tackle the spread of the deadly flu have also turned out as a key obstacle for the expansion of FDI, Rashid said.

Chief executives of global companies are now unable to visit their probable investment destinations due to the restriction, he said.

In addition, the country's FDI is shifting its pattern.

In the past, foreign investors preferred investing in power plants, private hospitals, banks, and non-bank financial institutions.

"Now, they are thinking of investing in fintech, pharmaceutical industries, LNG plants, and agro-based manufacturing units," Rashid said.

Intra-company loans dipped to $132 million in contrast to $1.33 billion in FY20. Reinvestment of earnings by existing foreign companies grew around 11 per cent to $1.51 billion.

"A good number of foreign investors are still shying away from the country to choose it as their investment destination," said Muallem A Choudhury, a director of Brummer & Partners (Bangladesh) Ltd, which advises foreign businesses looking to invest in the country.

The lock-in period for a foreign investor in the country is three years, which is excessively higher than in many other competing nations, he said.

The lock-in period means investors, who hold 10 per cent shares in a company or directorship, are not allowed to sell shares within the stipulated period.

This means the exit from Bangladesh is difficult, Choudhury said. "The lock-in period for foreign investors should be reduced to one year."

Brummer & Partners, which started its journey in 2009, has so far attracted $200 million in equity capital from foreign businesses to the country, he said.

The volume of domestic consumption is large, given the size of the population. Still, per capita income has not reached to a satisfactory level, Choudhury said.

Per capita gross domestic product in Bangladesh was $1,816 in 2019.

Bureaucratic complexity should be avoided as it irritates foreign investors, Choudhury said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments