DSE sees rare rise in turnover

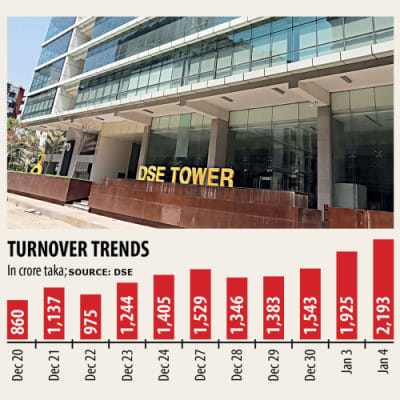

Stocks turnover rose yesterday to the Tk 2,000 crore range, a rarity for the Dhaka bourse over the past decade.

This important indicator of the market went up 13.9 per cent to Tk 2,193 crore, the highest since June 28 last year.

That day, the DSE witnessed a turnover of Tk 2,543 crore, driven by share transfers of GlaxoSmithKline to Unilever.

A turnover of Tk 2,000 crore was first seen in the bourse in late 2010 and for a few days in 2017.

"As the deposit rate is very low in the banking sector, some investors are shifting their funds to the stock market," said a top official of a leading brokerage house.

On the other hand, when the market goes up, people gain confidence and funds flow in, he said, adding that the market had already gained confidence.

But investors need to be cautious otherwise they will incur losses, drying up the market again, he added.

The DSEX, the benchmark index of the DSE, rose 33.36 points, or 0.59 per cent to 5,652.32 yesterday.

Among 362 companies, 157 advanced, 142 declined and 63 remained same.

As the market has been uplifted to a position not witnessed for many years, some investors got the chance to sell off shares they had invested in many years ago, said Mohammed Rahmat Pasha, CEO of UCB Capital Management.

They are selling shares and buying new scripts, so turnover rose, he said.

Some of the shares being traded had been stuck for being deemed negative equity, Pasha said, adding that they were buying new shares too. "This is a good side of the market now."

Banks are investing their funds into the stock market because they found it to be more lucrative than lending, said a merchant banker.

On one hand, the difference between deposit rate and lending rate is lower and on the other, the business environment is still challenging due to the aftermaths of the pandemic, he said.

Already, some banks took up a Bangladesh Bank loan offer to form funds of Tk 200 crore for investing in the stock market, the merchant banker added.

The banks will have to pay 5 per cent interest for the fund and the credit tenure will be until February 2025.

The lenders will be allowed to show the fund as special investment, which will not fall within the purview of the banks' stock market exposure of up to 25 per cent of their capital.

AIBL First Mutual Fund topped the gainers' list, rising 10 per cent, followed by Vanguard SML Rupali Bank Balanced Fund, Zeal Bangla Sugar Mills, GBB Power and Crystal Insurance.

Beximco was the most traded stock, worth Tk 253 crore, followed by Beximco Pharmaceuticals, LankaBangla Finance, LafargeHolcim Bangladesh and IFIC Bank.

BD Finance shed the most, losing 7.74 per cent, followed by GQ Ball Pen, Sonar Bangla Insurance, Sonali Ansh and JMI Syringes.

The port city bourse also rose yesterday. The benchmark index of the Chittagong Stock Exchange, CSCX, rose 60 points, or 0.62 per cent, to stand at 9,871.

Of the 291 stocks to witness trade, 147 rose, 104 fell and 44 remained unchanged.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments