Move fast to attract more FDI

Business leaders and analysts yesterday called for sorting out the longstanding deficiencies that dissuade overseas investors after foreign direct investment flow to the country declined for the first time in five years.

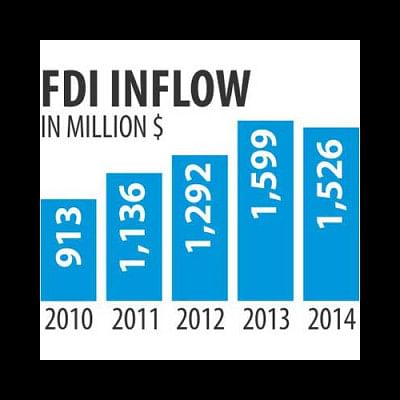

The country received $1.53 billion in FDI last year, down 4.57 percent year-on-year, according the World Investment Report 2015 of the United Nations Conference on Trade and Development (Unctad).

The report was unveiled in the country by the Board of Investment (BoI) at its office in Dhaka on behalf of the United Nations agency.

“We have to look at the issues that are holding back the foreign investors,” said Rupali Chowdhury, president of the Foreign Investors' Chamber of Commerce and Industry.

“Is it corruption, red tape or a lack of coordination among the ministries? If we have an image crisis at the international level, we have to work on it,” she added.

Ruling party lawmaker Mohiuddin Khan Alamgir said the shortages of power, gas and industrial land have to be addressed to attract both foreign and local investment.

SA Samad, executive chairman of BoI, however, said the situation is not alarming as the dip in the FDI flow is not a “major collapse”.

Worldwide, FDI inflows declined 16 percent year-on-year to $1.2 trillion last year because of the fragility of the global economy, policy uncertainty for investors and elevated geopolitical risk.

“However, recovery is in sight in 2015 and beyond,” said the report, adding that FDI flows now account for more than 40 percent of external development finance to developing and transitioning economies.

China replaced the US as the recipient of the most FDI in the world.

In South Asia, apart from Bangladesh, FDI flow to Afghanistan, Bhutan, Nepal and Iran all went down.

In contrast, India, Pakistan and Sri Lanka saw their FDI inflow rise, said M Ismail Hossain, chairman of the department of economics at North South University, while making a presentation on the report.

India attracted the most FDI, receiving $34 billion during the calendar year. Pakistan's receipt increased 31 percent to $1.7 billion.

In Bangladesh, the manufacturing sector received the highest FDI of $722.88 million, followed by trade and commerce at $366 million, and transport, storage and communications at $235 million.

The net inflow to the power, gas and petroleum sector was $49.84 million.

The disclosure was met with disbelief by Tawfiq-e-Elahi Chowdhury, energy adviser to the prime minister, who said a huge amount of FDI is flowing into those sectors.

“But these investments are not being reported at the end of the year,” he added.

Both Samad and the energy adviser said the gross FDI inflow of $2.058 billion should be the real external investment that flowed into the country last year.

The gross FDI inflow was reported for the first time after a central bank committee headed by its Deputy Governor Nazneen Sultana counted all the investment flowing into the country from abroad as FDI.

Sultana said the companies take the money out as cost recovery as per the rules of the central bank, so they do not report them as FDI at the end of the year.

She said this normally happens in case of international oil companies, citing the case of US energy giant Chevron as a case in point.

Chevron invested $500 million in the country but took out $450 million as cost recovery.

“When this type of investments is made, this has impact on economic activities. So, we have started to take them into account while compiling FDI data.”

The prime minister's energy adviser also said the government will ask the Unctad to consider all investments flowing into a country as FDI.

Country-wise, the UK sent the highest amount of FDI of $180.98 million to Bangladesh, followed by South Korea at $134.70 million and Pakistan $130.74 million.

The Unctad said there is a pressing need for systematic reforms of the global investment agreement regime.

The reforms should address the main challenges: safeguarding the nations' right to regulate agreements' limit in the public interest, reforming investment dispute settlement system, ensuring responsible investment to maximise positive impact of foreign investment, and minimise its potential negative effects. Nabhash Chandra Mandal, executive member of BoI, also spoke.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments