Mobile cash jumps 47pc in January

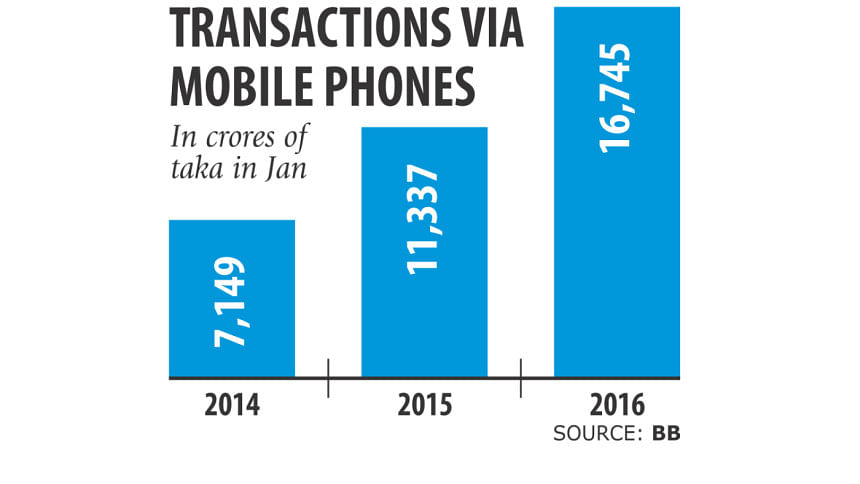

Transactions through mobile phones rose 47.7 percent year-on-year to Tk 16,745.27 crore in January thanks to increased economic activities at the grassroots level, according to Bangladesh Bank data.

The amounts were Tk 11,337 crore in January last year and Tk 7,149 crore in the same month of 2014.

Average transaction per active account stood at Tk 12,282 in January this year, up from Tk 10,257 in the same month last year. The market for mobile financial services is yet to pick up, and the banking regulator is unhappy with the current transaction patterns, most of them being cash-in or cash-out transactions.

In the last few years, low-income people started taking part in economic activities seriously, which resulted in a rise in the volume of mobile transactions, said Subhankar Saha, executive director of the BB.

Person-to-person transaction, salary disbursement and utility bill payments are not increasing much, revealing how immature the sector still is, said Saha, who is also the spokesperson for the central bank.

In January, cash-in transaction volume was Tk 6,969 crore, about 41.62 percent of the total transactions, while cash-out transactions were Tk 6,128 crore or 36.6 percent of the total.

In 2015, cash-in transactions accounted for 41.83 percent of the total volume, while cash-out transactions were 36.82 percent.

Saha said they are trying to help increase salary disbursement, utility bill payments and other transactions through mobile banking to help diversify the sector.

In January, salary disbursement through mobile banking amounted to Tk 157.79 crore while utility bill payments were of Tk 114.73 crore.

The BB asked banks to add tuition fees and other services to their menus so that users get more options, Saha said.

As of January, around 1.36 crore mobile banking accounts are active, out of the 3.31 crore registered.

Many people open mobile banking accounts, but stop using those later due to a lack of confidence, said a senior official of a bank.

Banks should put efforts to help mobile financial services flourish, he said.

Any account that is not used for transactions for 90 days is considered inactive under the current rules of the BB.

As the number of inactive accounts is increasing every month, the central bank plans to change the definition of those accounts by extending the time scale to 180 days, the official said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments