MFS accounts soar amid cuts in transaction limits

The number of mobile financial service (MFS) accounts marked a drastic rise in February after the central bank lowered the transaction ceiling.

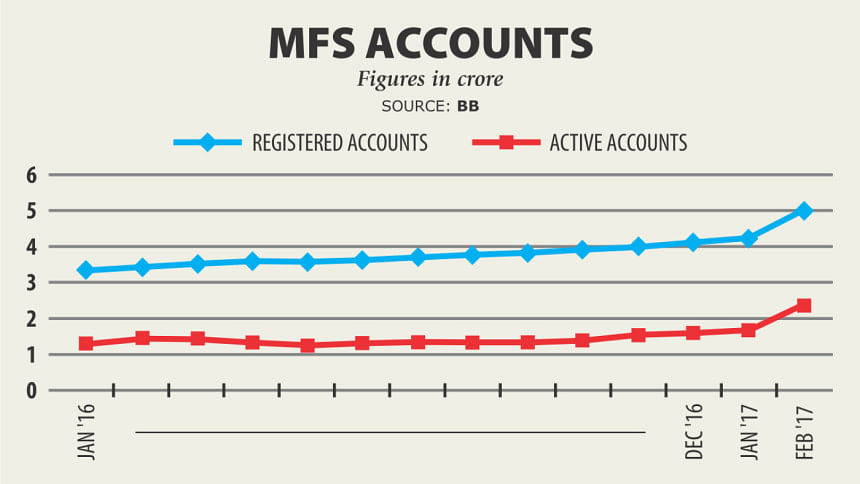

Active mobile money accounts soared 44.85 percent to 2.39 crore in February compared to the previous month, but the total transaction value dropped 11.42 percent.

The number of total registered accounts increased 18.89 percent to 4.99 crore in the month, according to a Bangladesh Bank report on MFS.

It was predicted that the transaction value would decline after the new limits were imposed, but the rise in the number of active accounts was a surprise, said industry insiders.

“If users were to maintain the same transaction value as before, they would need to open new accounts. And they did so,” said Abul Kashem Md Shirin, managing director of Dutch-Bangla Bank, a leading MFS provider that operates the Rocket brand.

In other words, mobile money users who previously used 10 SIMs for their transactions now have 15 to 20 SIMs to maintain that level. “This is the only difference now,” said Shirin.

Previously, users could deposit Tk 25,000 into their mobile wallets each day and take out the same amount. But now, they have to make do with Tk 15,000 for cash-in and Tk 10,000 for cash-out, after an order of the central bank came into effect on February 1.

Md Mahbubur Rahman Alam, associate professor of the Bangladesh Institute of Bank Management (BIBM), said it is clear that the rise in the number of accounts is a result of lowering the ceiling.

“Initially, it seems like a positive outcome, but we have to wait a couple of months to see the real results.” When contacted, Bangladesh Bank spokesman Subhankar Saha said the rise in the number of MFS accounts seems unusual.

“A drop in the transaction ceiling might be a reason behind that, but we have to wait further to draw a conclusion,” he said.

An MFS agent on Iqbal Road in the capital's Mohammadpur area said the limit has inconvenienced mobile money users, but it led to the opening of more accounts to offset the fallout.

“Both the value and volume of mobile money transactions dropped 40 percent in the first week of February. But it later recovered after new accounts were opened,” said the agent, requesting anonymity.

In January, the daily average MFS transaction value was Tk 840.20 crore, which fell to Tk 797.40 crore in February.

The Bangladesh Bank report also mentioned that the number of agents declined 3.65 percent to 696,722. The MFS providers became stricter on compliance after the directive, said officials of MFS providers.

Many agent affiliations were cancelled in the case of irregularities, they added.

Of the different categories in MFS payments, salary disbursement was affected the most. In January, Tk 349.21 crore was disbursed as salaries through the MFS channel, which fell to Tk 260.23 crore in February, according to central bank data.

A good number of companies that disbursed their workers' salary through mobile money cannot do so now, as the new ceiling does not cover their salaries, said a top executive of an MFS provider.

Students, garment workers and small entrepreneurs were affected the most by the central bank's directive, according to the MFS providers. One of the main objectives of reducing the transaction ceiling was to bring remittance in through the formal banking channel.

However, remittance through that channel did not increase, rather, it declined 17.6 percent year-on-year to about $936 million in February, which was the lowest this fiscal year.

Shirin of Dutch-Bangla Bank earlier suggested that the central bank block cash-out from the MFS accounts. According to his proposal, customers could use their mobile wallets for purchases and to pay bills, but not to take out as cash.

“If the regulator considers our recommendation, it will help the industry become more mature and help us move to a cashless society,” said Shirin.

Alam of BIBM said it is simply impossible to stop fraudulent activities by only bringing down the transaction limits. “The banking regulator has to think optimistically.”

Currently, there are 19 MFS licence holders and 17 of them are offering the service. However, two operators -- bKash and Rocket -- have 99 percent of the market share.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments