Machinery imports soar but investment declines

Capital machinery imports soared 83 percent year-on-year in the first four months of the fiscal year, but industrial term-loans dropped 22 percent during July-September period from a year earlier, showing a mismatch between the two indicators.

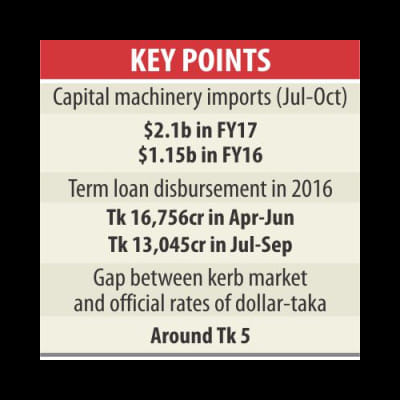

Capital machinery imports rose to $2.1 billion during the July-October period from $1.15 billion a year earlier, according to letters of credit settlement data from the Bangladesh Bank.

LC opening for imports of capital machinery also increased 26.44 percent during the four-month period, meaning equipment is coming to Bangladesh for setting up new industrial units.

Given the upward trend in capital machinery imports, investment is supposed to go up thanks to new industrialisation or expansion. But industrial term-loan disbursement declined to Tk 13,045 crore in the July-September period from Tk 16,756 crore in the previous quarter.

Industrial term-loan disbursement increased 9.83 percent in fiscal 2015-16 and 41.21 percent in fiscal 2014-15.

The boom in capital machinery imports would have been good news if it had been driven by resurgence in private sector investment, said Zahid Hussain, lead economist of the World Bank's Dhaka office.

Unless these include imports for public construction projects, it is hard to find a reasonable explanation for the uptick, he said.

It could not have been due to an increase in private industrial investment as that is not consistent with the 62 percent decline in net disbursement of industrial term loans in the first quarter of fiscal 2016-17 from a year earlier.

The possibility of misclassification of imports to evade import duties or over-invoicing motivated by capital flight cannot be ruled out, he said.

“Nor can we rule out the possibility that imports for public sector construction projects may have driven the growth.”

If that indeed is the case, then the extraordinary growth in machinery imports does not reflect any turnaround in investment behaviour in the private sector, he added.

Usually, the difference in exchange rates between the kerb market and the official rate remains within the range of Tk 1, bankers said. But the gap crossed Tk 1 several months ago, and now is more than Tk 5.

The huge gap indicates a possible capital flight from the country.

From July to the first week of November, the dollar-taka exchange rate in the kerb market was between Tk 80.9 and Tk 81.7, while the official rate was Tk 78.4.

The kerb market rate again started increasing from November 11 and stood at Tk 83.5 yesterday.

The official rate was Tk 78.85 during the period.

A Bangladesh Bank official said the demand for dollars increased after de-monetisation started in India in the first week of November.

However, Zaid Bakht, former research director of the Bangladesh Institute of Development Studies, said investment increased slightly due to interest rate cuts and the implementation of some government mega projects.

The implementation of government mega-projects is having a positive impact on private sector investment, he said.

Private entrepreneurs are making new investment in the power sector and going for project expansion of the existing ones, said Bakht, also the chairman of state-run Agrani Bank.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments