Loan defaults keep swelling

Banks' loan defaults continue to soar in 2016, rising 6.65 percent in the second quarter to Tk 63,365 crore.

At the end of the first quarter, the total defaults stood at Tk 59,411 crore, according to central bank statistics.

In percentage terms, the increase in defaults in the second quarter is insignificant, said SK Sur Chowdhury, deputy governor of the central bank, when asked about the rise in bad loans.

Defaults at the end of June were 10.06 percent of the total outstanding loans. On March 31, it was 9.92 percent, meaning the bad loans increased by 0.14 percentage points over three months.

Bangladesh Bank has taken several steps to improve the banks' default loan scenario, Chowdhury said.

In the second quarter, the state banks' default loan situation deteriorated more.

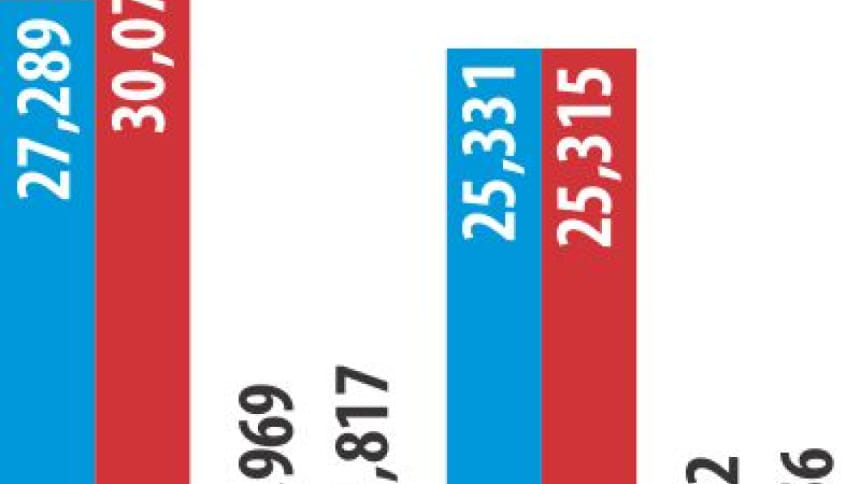

The defaults of the six state-owned commercial banks swelled by Tk 2,788 crore to Tk 30,077 crore, which is 25.74 percent of their total outstanding loans.

Of them, the two specialised banks' defaults rose 17 percent in the second quarter compared to the first quarter. In percentage terms, their default loans accounted for 26.14 percent of their total outstanding loans.

Bad loans are rising for two reasons, said Khondker Ibrahim Khaled, a former deputy governor of BB.

“They were sanctioned either without due diligence or through corrupt practices,” he added.

In the second quarter, the bad loans in private banks decreased slightly. They dropped by Tk 16 crore to Tk 25,315 crore, which is 5.44 percent of their total outstanding loans.

Defaults at foreign banks were Tk 2,156 crore as of June, accounting for 8.33 percent of their total loans. At the end of March, they stood at Tk 1,822 crore, which was 7.5 percent of the total loans.

If the amount of loans that were written off is taken into account, the bad loan scenario becomes worse.

Until December 31, 2015, Tk 40,361 crore of loans were written off, some of which were later realised.

Following the write-offs, the total outstanding loans stood at Tk 33,581 crore. If this amount is taken into account, the total bad loans in the banking system at the end of June would be Tk 96,946 crore.

In the monetary policy statement released in June, the central bank said the efforts to curb defaults will be intensified this fiscal year.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments