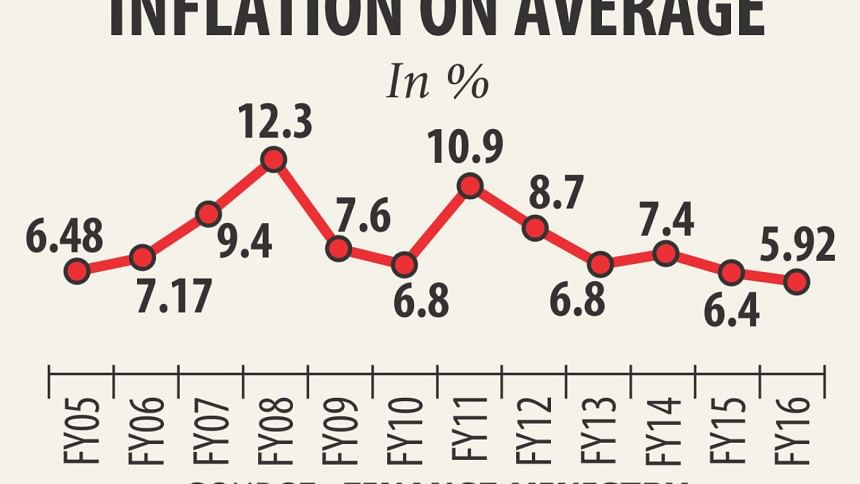

Inflation lowest in 12 years

Inflation stood at 5.92 percent on average in fiscal 2015-16 -- the lowest in 12 years and even lower than the government's budgetary target of 6.2 percent.

The central bank apprehended a rise in inflation last fiscal year due to the pay rise for government staff, but it fell 0.49 percentage points over fiscal 2014-15.

In fiscal 2014-15, inflation was 6.41 percent.

“Inflation has declined mainly due to satisfactory agricultural production, reduction of commodity prices, including fuel in the international market, prudent macroeconomic management and a normal flow in the supply of goods thanks to political stability,” said Finance Minister AMA Muhith in his budget speech last month.

Zahid Hussain, lead economist of the World Bank's Dhaka office, said inflation has remained below the Bangladesh Bank's target in fiscal 2015-16, largely due to a sharp decline in food inflation.

Food inflation was 4.92 percent last fiscal year, down from 6.68 percent the previous year, according to the Bangladesh Bureau of Statistics.

The decline is attributable to low food inflation internationally that contained the cost of imported food items, good domestic harvests, particularly rice, and a stable exchange rate, according to Hussain.

Non-food inflation stood at 7.45 percent last fiscal year, up from 5.99 percent the previous year.

The rise is due to the increase in demand resulting from implementation of the new pay scale for government employees, adjustment in the administered prices of gas and electricity, and a sharp uptick in the flow of credit to the private sector, a large part of which financed consumption expenditures, he said.

In May, private sector credit growth accelerated 16.4 percent against the target of 14.8 percent by June this year, as stated in January's monetary policy statement.

The WB economist went on to mention some risks that stand in the way of achieving the inflation target set for the current fiscal year.

“Moving forward, sound macroeconomic management will be important to attain the 5.8 percent inflation target for fiscal 2016-17.”

Food prices in international markets have tended to rise in recent months, as did oil prices, which pose a risk for food inflation.

Containing non-food inflation will be a challenge because of fiscal expansion and the lagged effects of wage increases, he said.

“The forthcoming monetary policy statement for the first half of fiscal 2016-17 will hopefully pay enough attention to the downside risks in setting the monetary programme targets and deciding on the policy rates,” Hussain added.

The BB will announce its new monetary policy statement at the end of this month. However, it is not likely to be expanded much because of the risks, a BB official said, asking not to be named.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments