High prices lure farmers to jute cultivation

Farmers have sown jute on more lands this season for greater profits after many growers incurred losses due to low prices of rice and other crops.

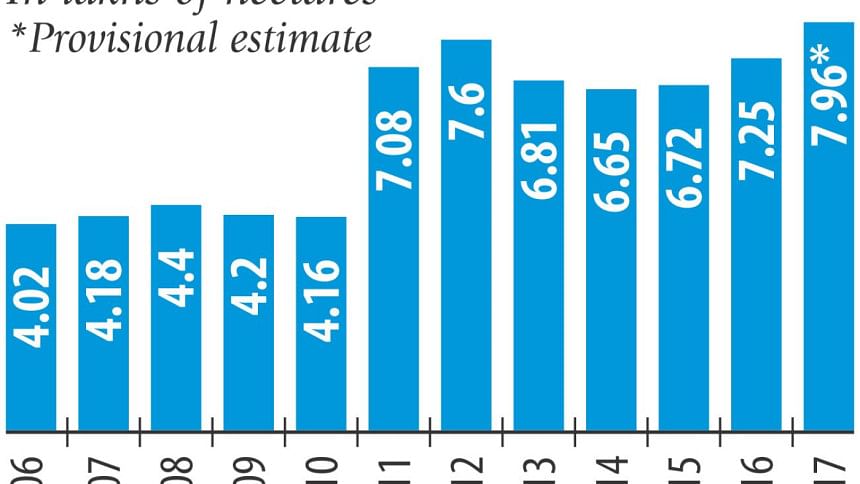

Jute farming rose 10 percent to 7.96 lakh hectares this season, compared to the previous period, according to a provisional estimate by the Department of Agricultural Extension or DAE.

“It appears that the high prices of jute have encouraged growers. Many farmers switched to jute as they were frustrated by low prices of rice,” said a senior official of DAE, asking not to be named.

In the past couple of months, the prices of coarse and medium varieties of paddy hovered between Tk 550 and Tk 660 a maund, which is lower than the government's estimate of production cost.

Farmers spent Tk 18.5 and Tk 20.7 to produce one kilogram of aman and boro paddy respectively, according to the food ministry.

The prices of staple have fallen after the beginning of boro paddy harvest. Currently, the prices of coarse paddy are less than Tk 400-500 each maund, said Nirod Boron Saha, a rice wholesaler at Naogaon.

By contrast, raw jute traded between Tk 2,200 and Tk 2,350 a maund now. The price of the fibre was between Tk 1,600 and Tk 1,700 at the beginning of the harvesting season, said traders and industry operators.

“Jute prices look attractive now,” said Mohammad Ali, a farmer in the northwestern district of Bogra, who farmed jute on about one acre of land this year. He cultivated maize on the same land last year.

“I switched from maize to jute due to low prices. The demand for jute is likely to sustain as the use of jute sacks for packaging has risen.”

Farmers' switch to jute is reflected in the reduced acreage of boro rice farming this season, falling to 46.85 lakh hectares this year from 48.4 lakh hectares a year ago, according to DAE.

The enforcement of the law that mandates the use of by jute sacks for packaging has fuelled its demand, said Shahidul Karim, secretary general of Bangladesh Jute Spinners Association.

The government started enforcing the compulsory use of jute sacks for packaging, particularly for rice, by the end of 2015, thanks to the law that was passed in 2010 to cushion the jute sector and limit the use of the environmentally harmful plastic bags.

The use of jute in making sacks has risen by 10-15 percent, said Abdul Barik Khan, secretary of Bangladesh Jute Mills Association.

Low jute production in India also influenced the price here, said Prabir Saha, a jute trader in Faridpur, one of the major jute growing districts.

Bangladesh's local jute mills process nearly 50 lakh bales of raw jute a year, mainly to export.

Some 10 lakh bales are exported a year while the rest are used for household purposes, said Karim.

Export receipts from jute and jute goods grew just 1 percent to $729.87 million in July-April this fiscal year from a year ago.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments