Fuel price cuts in Jan

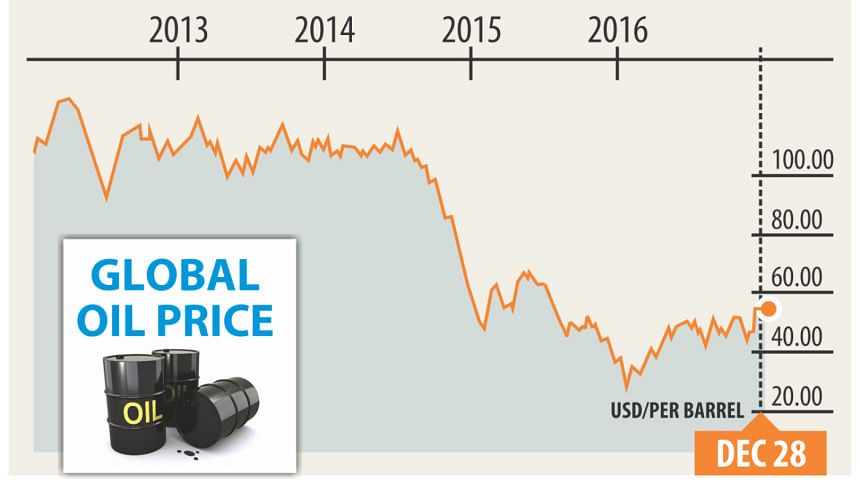

The government plans to slash fuel prices next month by taking into account the base price of $60 per barrel, Finance Minister AMA Muhith said yesterday.

Bangladesh had earlier lowered the fuel price in April by setting the base price at $80 per barrel.

So the upcoming cut will not make a very big difference, Muhith told reporters at his secretariat office.

In April, Bangladesh cut the prices of octane and petrol by Tk 10 a litre and diesel and kerosene by Tk 3, with the intention of passing on the benefits of low prices on the international market to consumers.

The prices of diesel and kerosene are now Tk 65 a litre, octane Tk 89 and petrol Tk 86.

The fuel price cut was scheduled for December but the month is almost finished, Muhith said, adding that he is yet to meet with the prime minister over the issue.

He now hopes the price cut will take place in January. “Oil price is something everyone is affected by.”

Crude oil traded at $56.27 per barrel yesterday, almost double its low in January, according to Bloomberg News.

Next year, on an average, it may trade at $60 per barrel, according to the Gulf Research Centre.

In November, the issue of fuel price cut was discussed at a meeting of the Fiscal Coordination Committee chaired by Muhith.

At the meeting, the recommendation for the fuel price cut was made, he said yesterday.

When the government lowered the fuel price in April, it said the cut would be part of a government plan to reduce the fuel prices in three phases.

After lowering the price in April, it now costs Bangladesh Petroleum Corporation Tk 61.25 for producing a litre of octane, Tk 62.5 for petrol, Tk 49.25 for diesel and Tk 48.25 for kerosene.

Despite the cut, BPC will still make a profit of Tk 27.75 a litre on octane, Tk 23.5 on petrol, Tk 15.75 on diesel and Tk 16.75 on kerosene.

So the state-run company, which is the country's lone importer, refiner and marketer, will still make a huge amount of profit despite the price cuts.

If the prices are cut, the transport, power and agriculture sectors will be benefitted and investment will also go up, according to the finance ministry analysis. A 10-percent cut in petroleum price will lead to a rise in both the gross domestic product and private investment by about 0.3 percent, according to the Centre for Policy Dialogue, a think-tank.

Inflation will come down by 0.2 percentage points, it said earlier in January. Export, on the other hand, may increase 0.4 percent.

Households are likely to be benefitted, with a 0.6 percent rise in consumption on average, while firms' income may increase by the same margin.

The consumption of households in rural areas is expected to increase 0.7

percent.

This analysis also reflects the finance minister's comment made yesterday.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments