Private sugar refiners irked by curbs on imports

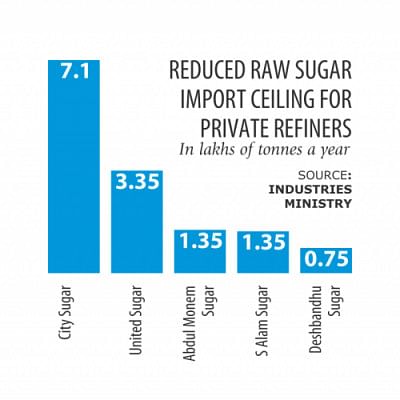

The government has brought down the ceiling for raw sugar imports by 50 percent and banned setting up of new refineries and expansion of existing ones by private refiners as a helping hand for struggling state-owned mills.

The decision, which was taken on January 20 this year, has irked private refiners, who said it would be tough for them to survive.

"The big refiners may get by, but small players like us cannot -- by operating at half the production capacity. There are massive fixed costs," said Golam Rahman, managing director of Deshbandhu Group that runs a sugar refinery.

Its annual capacity is 1.5 lakh tones, but it is now allowed to import only 0.75 lakh tonnes of raw sugar, he said. The restriction, Rahman says, will give rise to bank defaulters.

Likewise, Meghna Group-owned United Sugar Mills is allowed to import only 3.35 lakh tones raw sugar this year, down from over seven lakh tones in the previous year.

"The sudden quota system will hurt our business," said Mostafa Kamal, chairman and managing director of Meghna Group of Industries.

He said banks have given loans to United Sugar Mills based on its production capacity of seven lakh tonnes a year.

The mill has now been restricted to 3.35 lakh tonnes, which is not viable for the lender or the borrower.

At present, the country's annual demand for sugar is 15 lakh tonnes, according to the industries ministry.

State-owned 15 sugar mills produce only 1.28 lakh tonnes a year and the remaining demand is met by imports by just five private refiners.

Data shows private refiners imported 19 lakh tonnes of raw sugar in fiscal 2013-14, of which City Sugar Industries alone imported 10 lakh tonnes.

The remaining amount was imported by United Refinery, Abdul Monem Sugar Refinery, S Alam Refined Sugar and Deshbandhu.

City Sugar Mills, the country's largest sugar refiner, set up a second unit with capacity of 3,000 tonnes a day, promising to export at least 50 percent of the output. In reality, it could not export, which oversupplied the local market, industry insiders said.

"We had exported last year, but this year we cannot because of falling prices in international markets," said Biswajit Saha, general manager of City Sugar. Global sugar prices in March neared six-year lows owing to robust supplies in Brazil, whose struggling currency was also dragging down the market.

Global production in the year ending September 30 will exceed demand by 620,000 tonnes, leaving record stockpiles of 79.89 million tonnes, or almost enough to supply the world's top seven consuming countries, according to a Bloomberg report.

India, the second-largest producer, will have the biggest harvest in three years at 26 million tonnes, a Bloomberg survey showed. A Thai industry group estimated cane output rose 6.1 percent this season.

Amid the situation in Bangladesh, private refiners sat at an emergency meeting on Tuesday to discuss their next course of action.

A letter will be sent to the industries ministry, urging it to reconsider its decision on import restriction, Saiful Alam, president of Bangladesh Sugar Refiners' Association, told The Daily Star after the meeting.

The government cannot impose this embargo in an open market economy, Alam, also the chairman and managing director of S Alam Group, said.

Asked, Mosharraf Hossain Bhuiyan, secretary of the industries ministry, said restriction on imports was taken in consultation with the refiners.

It is a temporary decision to discourage imports, he said. The decision will help state-owned mills sell its stock of 1.5 lakh tonnes sugar, which, he said, was not being sold despite its better quality.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments