DSE refuses to perk up despite BB move

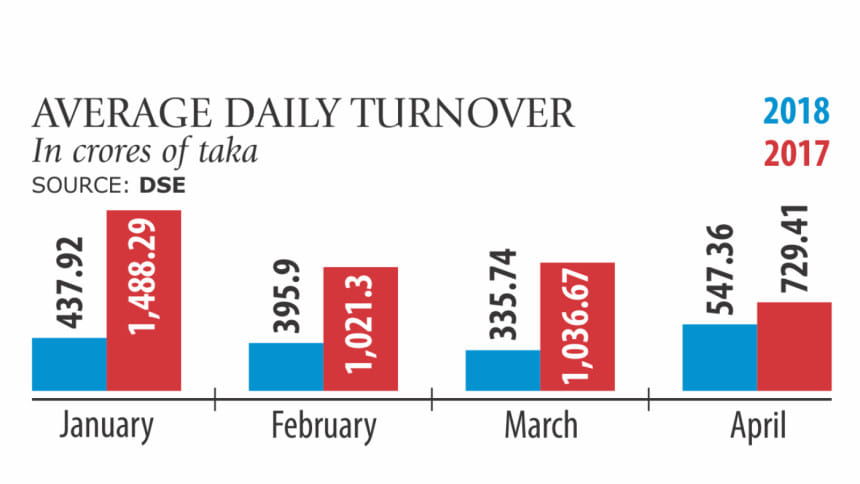

The daily average turnover of the premier bourse, an important indicator of its vitality, dropped 24.95 percent in April to Tk 547.36 crore from a year earlier even after the central bank took a host of measures to ease the flow of money into the stockmarket.

Recently, the Bangladesh Merchant Bankers Association along with DSE Brokers Association identified liquidity crunch in the financial sector as one of the reasons behind the lower turnover in the market.

Subsequently, the two associations and directors of some banks last month requested the Bangladesh Bank to loosen the noose, which the central bank obliged to.

Furthermore, fear of political uncertainty in the coming months and lower dividend declarations by the heavyweight banking sector are making investors stall.

“Investors are disheartened,” said Abu Ahmed, former chairman of the Dhaka University's economics department and a stockmarket expert. Investors put in their money in the capital marker to make profit, but this year listed companies are announcing dividends lower than their expectations.

“So, some are pulling out their investment from the stockmarket or holding back from making any new investment,” he added. Market insiders said if the political calm continues investors will come to the market.

“Some bank directors used the market to get their demands met by the central bank,” said the managing director of a merchant bank requesting anonymity.

The main problem with the stockmarket is the lack of investor confidence, he said.

The BB has lowered the cash reserve ratio by 1 percentage point to 5.5 percent and made funds cheaper for all banks by reducing the repo rate by 75 basis points to 6 percent. Both the initiatives become effective from April 15. The banking regulator extended the deadline for banks to lower their advance-deposit ratio (ADR) to March 31 next year from June 30 this year.

In a separate move, the central bank on April 17 allowed state enterprises to deposit 50 percent of their funds with private banks, up from the previous ceiling of 25 percent.

“Dividend declaration by listed companies this year is not at the expected level, so turnover has been affected,” said Mostaque Ahmed Sadeque, president of the DSE Brokers Association.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments