Current account deficit widening

Current account deficit widened further in the first six months of the fiscal year on the back of the sliding remittance inflow and slow export growth.

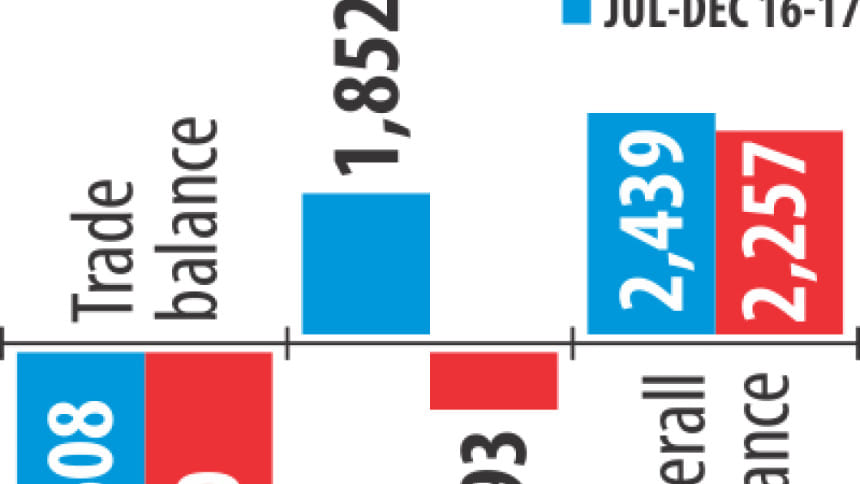

Between the months of July and December of 2016, the current account deficit stood at $793 million in contrast to $1,852 million in the surplus a year earlier, according to the central bank's balance of payments data.

The current account balance set foot into the negative territory for the first time in four years in the first quarter of fiscal 2016-17: the deficit was $504 million and every month it has been gradually increasing.

The last time the current account was in the deficit -- of $447 million -- was way back in fiscal 2011-12. Since then there had been no deficit in the current account balance at any point in time.

A major source of foreign currency for the country in the last 10 to 12 years has been remittance sent by expatriate Bangladeshis, which also keeps the external balance sheet in a strong position. In the first six months of the fiscal year, remittance dropped 17.65 percent -- a development that has created a pressure on the current account balance.

Remittance inflow fell due to low oil prices on the global market and a growing preference among the expatriates for hundi, an illegal way to transfer funds from abroad.

Strong import growth coupled with a moderate rise in export and a slowdown in remittance inflow contributed to the deficit, said the Bangladesh Bank's latest monetary policy statement (MPS), which was unveiled last month.

In the first six months of fiscal 2016-17, imports rose 8.91 percent while exports grew 4.33 percent, both of which resulted in the further widening of trade deficit.

Trade deficit stood at $4.5 billion during the period in contrast to $3.6 billion a year earlier.

However, the BB predicts that at the end of the fiscal year the current account deficit will come down to within $600 million on the back of a pick-up in remittance and export.

Export is expected to pick up, with improving growth outlook in some advanced economies, the MPS said.

“But this outlook is subject to substantial geopolitical risks and policy uncertainties in the US, the UK and the euro area.”

The declining remittance is likely to receive some support from the higher number of workers going abroad and the better economic prospects in the Middle East, aided by rising oil prices, said the MPS for the second half of fiscal 2016-17.

BB Governor Fazle Kabir last week told reporters that they have been doing a diagnostic review of the cause of the fall in remittance inflow.

A central bank team will visit a number of countries to get a first-hand idea and actions will be taken on the basis of its recommendations, he added.

However, a strong capital and financial account performance underpinned by net foreign direct, portfolio and other investments led to an overall balance surplus of $2.25 billion during the July-December period of 2016. A year earlier, it was $2.44 billion.

The MPS projected that the overall balance surplus at the end of the fiscal year would be about $2.9 billion, which was $5.04 billion in fiscal 2015-16.

Since the adoption of the flexible exchange rate regime in May 2003, the BB has allowed sufficient exchange rate movements, while smoothing out large day-to-day fluctuations.

After a prolonged spell of appreciation pressure on the taka, it has started to depreciate, although slowly, since October 2016, in line with the gradual erosion of the current account surplus.

While the exchange rate has remained broadly stable in the inter-bank foreign exchange market, it has moved by a larger margin in the kerb market recently, driven by a demand shock for cash dollar, in part stemming from India's demonetisation measure, the MPS said.

The BB has already initiated steps to iron out the impediments to the availability of cash US dollar notes in banks, it added.

On February 8, the average taka-dollar exchange rate stood at Tk 79.20, which was Tk 78.72 one year earlier, according to central bank statistics.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments