Credit growth up in Dec

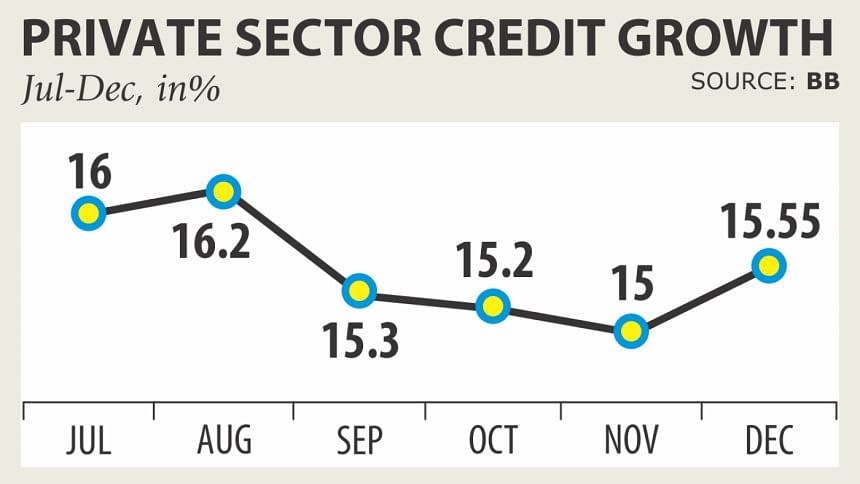

Private sector credit growth rose sharply in December last year, but was still far below Bangladesh Bank's target for the first half of 2016-17.

The credit growth was 15.55 percent in December, against the monetary policy's target of 16.6 percent, rising from 15.01 percent in November, according to Bangladesh Bank data. Total credit to the private sector stood at Tk 717,019 crore at the end of December, increasing from Tk 620,506 crore in the previous month.

Though private sector credit growth is on the rise, Bangladesh Bank kept the growth target unchanged at 16.5 percent for fiscal 2016-17 in the latest monetary policy announced on January 29.

The central bank projected that the credit growth ceiling will be enough to support the GDP growth target of 7.2 percent.

Private sector credit witnessed steady growth of over 15 percent in the last six months amid a stable political situation and lower lending rates.

The banking sector experienced a sharp fall in lending rates due to huge excess liquidity.

The weighted average lending rate in the sector stood at 9.93 percent in December last year, which was 11.18 percent in the same month in the previous year.

The lending rate of consumer financing came down to a single digit, even lower than business loans. The average interest rate on consumer loans was 9.83 percent as of December last year.

Banks are offering home loans at 5 percent to 9 percent, which is mostly cheap among the other long-term loans.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments