CPD opposes plans for corporate tax cuts

The Centre for Policy Dialogue has expressed strong reservations about the government's plan to lower corporate tax to boost private investment, saying the move would not have an adequate positive impact.

“The demand of the business community for lowering the corporate tax rates calls for close examination and a detailed analysis,” Fahmida Khatun, research director of CPD, said at a press conference yesterday to unveil the think-tank's set of proposals for the upcoming budget.

The corporate tax rate in Bangladesh now ranges from 27.5 percent to 45 percent, and the finance minister and the chairman of the National Board of Revenue have already indicated that it would be lowered in the budget for fiscal 2014-15.

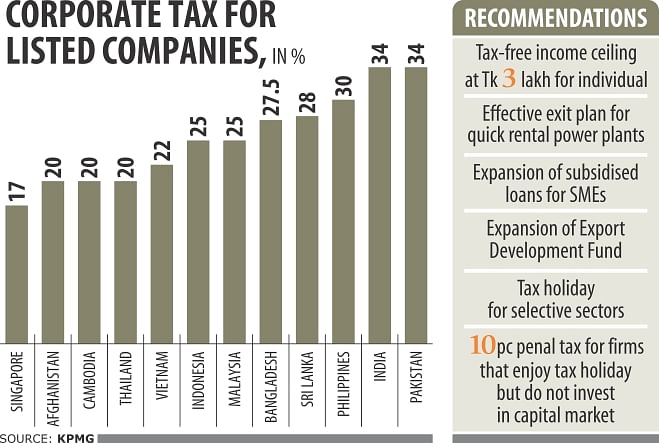

The logic of lowering the corporate tax rate on the ground that it is very high compared to other competing countries in Asia is not correct, CPD said.

The average corporate tax rate in Bangladesh is one of the lowest in South Asia, which is close to the average corporate tax of Southeast Asian countries, according to the think-tank.

“The argument that a lowering of the corporate tax will have a positive impact on private investment is not robust,” Khatun said.

In the backdrop of overt dependence on debt-based financing for investment by the corporate sector, a reduction of corporate tax rate may not have an adequate positive impact on investment.

If supportive measures such as a business-friendly environment and supportive infrastructure are not put in place, then an increasing investible surplus through lowering of corporate tax rate will likely have only a limited impact on investment, according to CPD.

The think-tank also placed several proposals for the next national budget, which if materialised will result in “higher” growth.

To improve the investment situation, the government may consider a number of fiscal measures such as expansion of subsidised credit facility for domestic market-oriented SMEs to help them recover their losses due to political turmoil, special incentives for export-oriented industries other than garments to improve their competitiveness and so on.

The Export Development Fund needs to be increased further from the existing balance of Tk 120 crore to support export-oriented industries. Tax holiday privileges provided to selected sectors need to be assessed from an efficiency point of view: whether it will be more preferable to go for selected 'strategically' and 'potentially' important sectors.

CPD said the government may also consider a number of fiscal measures for a set of targeted industries.

For instance, an increase in the exemption limit for VAT for SMEs from the existing Tk 80 lakh to Tk 1 crore, reduction of import duty on raw materials for the furniture and pharmaceutical sectors and withdrawal of import duty on networking machinery and data transmission link.

About public investment, the government should strengthen its monitoring activities to ensure speedy implementation of fast-tracked projects like the Dhaka-Chittagong four-lane highway, eleven large-scale power plants, expansion of gas connection in the industrial zones, completion of the Leather City in Savar and relocation of factories from Hazaribagh.

CPD found that there is a significant gap between the grower and retail level prices of agricultural produces. In order to ensure a fair price, it recommended setting up an agriculture price commission with adequate resource allocation.

A food safety authority should be set up to implement food safety rules and regulations.

CPD said the government should establish information technology centres across rural areas with funds from development partners.

These centres should have computers with high-speed internet connection and be openly accessible to the rural population.

The think-tank also called for an increase in overall allocation to social protection programmes.

It said a number of studies indicate that less than half of the eligible poor are receiving social benefit in Bangladesh. In view of this, the number of beneficiaries will need to be increased.

The administration of social safety net schemes needs to be rationalised and consolidated as well.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments