Banks move to curb dollar's rally

Foreign exchange dealers yesterday decided not to sell US dollar at rates higher than Tk 83, in a bid to stem the recent appreciation of the greenback.

The decision came at a meeting of the Bangladesh Foreign Exchange Dealers' Association, which was attended by senior treasury officials of 20 banks.

The move comes after the central bank on Tuesday served show-cause notice to the 20 banks for misreporting their Bills for Collection selling rate, which is the rate at which banks make import payments.

The BC sell rate went up to Tk 85 recently, when the official rate quoted by banks was less than Tk 83.

Amid the backdrop, BAFEDA called the meeting with the treasury managers, said Mohammed Nurul Amin, chairman of the association.

At the meeting, the top officials of the 20 banks said they had to sell dollar at a higher rate than their declared rate due to higher demand.

Moreover, there was a huge gap between demand and supply as Bangladesh Bank could not provide adequate dollar to banks.

"On behalf of the offender banks, BAFEDA will request the central bank not to impose any fine or punish them."

Amin, who is also the managing director of Meghna Bank, said the demand for dollar shot up in November due to a surge in imports and a slowdown in exports and remittance inflow.

Besides, the demand for foreign currency tends to spiral towards the end of a year as multinational companies remit their profits then, he said.

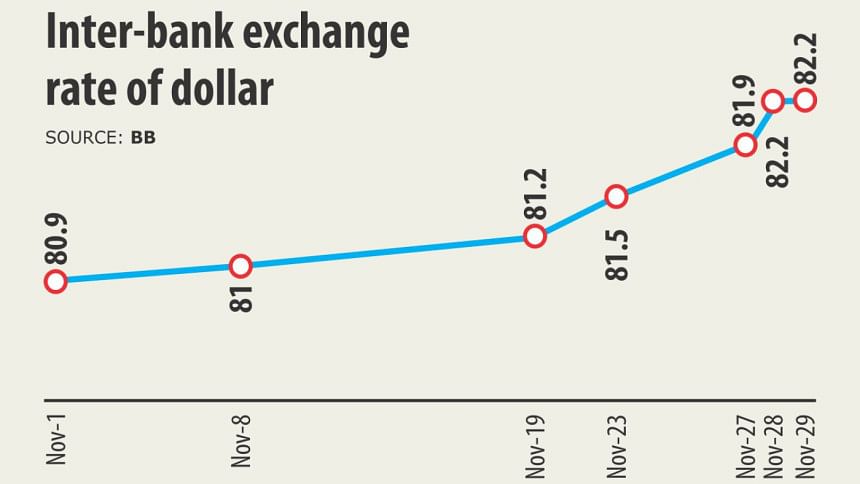

Meanwhile, the BB on November 28 raised the inter-bank exchange rate to 82.20 to match it with the demand. The rate was Tk 80.90 at the beginning of the month.

The BB also injected $28 million yesterday to take the tally thus far in November to more than $200 million.

"There is a gap between demand and supply of the greenback in the market," said Anis A Khan, managing director of Mutual Trust Bank.

The exchange rate market has become much broader now than ever before -- in line with the country's economic development.

"Now corporate bodies play in the exchange rate market, which was not seen before," he said, adding that an advanced mechanism should be in place for the market.

The dollar scarcity was due to an increase in investment activities, said a senior economist of the BB. "Some banks created an artificial crisis sensing the higher demand. But the rate will be stable within two weeks," he added.

The foreign exchange market experienced unrest earlier in April too, when the BC sell rate went up to Tk 84.65. The central bank then put a cap on the dollar at inter-bank exchange rate plus Tk 2 to arrest the depreciation of the local currency.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments