Banks giving low-cost loans to manufacturers

Banks are providing industrial loans at a maximum cost of 6.5 percent -- which is almost half the going interest rates -- from a fund provided by the World Bank, a development that will put a smile on the faces of businesses.

At present, the rate of interest on industrial loans is 11 to 12 percent, which businessmen say reins in their investment.

The WB last year provided $291 million to Bangladesh to extend long-term foreign currency credit to private sector firms. Subsequently, the government created a fund using the WB loan for disbursement through a select few commercial banks.

As of now, a total of 30 credit proposals have been received by the Bangladesh Bank, of which five have been sanctioned. The highest rate of interest on the loans is 6.5 percent, according to bank officials.

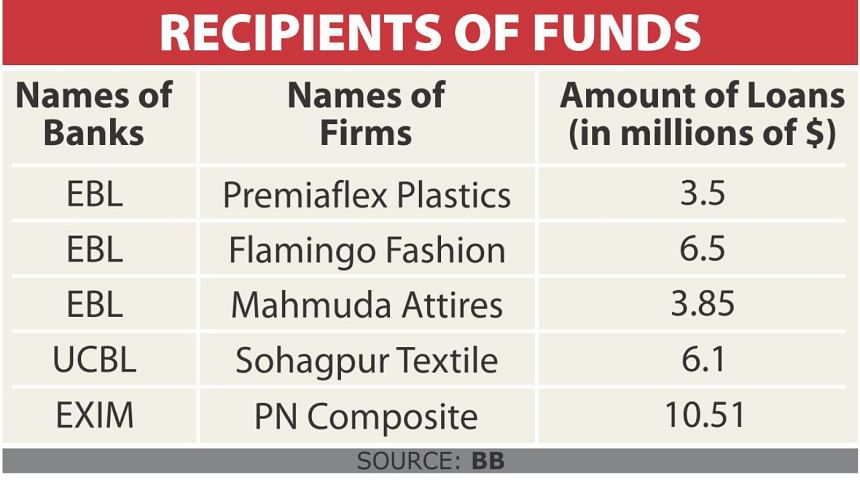

Eastern Bank has approved a total of $13.85 million for three firms: Premiaflex Plastics Ltd, Flamingo Fashions, and Mahmuda Attires Ltd.

Premiaflex Plastics Ltd got a $3.5 million loan at an interest rate of six-month LIBOR plus 3.25 percent and five years' tenure. The LIBOR (London Interbank Offered Rate) is less than 1 percent at present.

LIBOR is the rate at what banks charge each other for short-term loans in the London interbank market. It also serves as a global benchmark for short-term interest rates. The LIBOR will be followed because the loans will be given in foreign currency.

Flamingo Fashions, a knitwear factory, got $6.5 million at six-month LIBOR plus 3.5 percent. The tenure of the loan, which will be used for importing capital machinery, is 5.5 years including a six-month grace period.

Mahmuda Attires Ltd got $3.85 million loan under the same terms and conditions.

Exim Bank has approved a $10.51 million loan for PN Composite Ltd, a knitwear factory, at an interest rate of six-month LIBOR plus 3.25 percent. The repayment period is five years, which includes a year's grace period.

Sohagpur Textile Mills got $6.1 million from United Commercial Bank Ltd. The rate of interest on the loan is six-month LIBOR plus 3.25 percent and the repayment period is 5.5 years including one year's grace period.

The other 25 credit proposals are currently under review by the BB. "If they meet the WB criteria, the loans will be granted for disbursement very soon," said a central bank official.

The conditions put up by the WB address environmental sustainability, which, the official said, might be difficult for many businessmen to fulfil.

For instance, to get the loans, the industrial units must have effluent treatment plant (ETP) and water treatment plant.

"The corporate clients in Bangladesh are not accustomed to such conditions," said Golam Hafiz Ahmed, managing director of NCC Bank, one of the 25 banks selected to disburse loans from the WB fund. The conditions may ultimately push up the cost of doing business, he said, quoting some businessmen. The goods they would produce accommodating the cost may not be competitive in the market, he said.

"If rivers and environment are destroyed in the process of doing business, it is a national loss in the long-run," he said, adding that it is about time that the country looks to build green industries. It is not just the borrowers, the banks too must meet certain conditions to be able to disburse loans from the fund, the WB said. The bank must be of sound financial health, which disqualified all state banks.

The borrower's rate of interest is linked to the financial health of the bank. The WB will top up the fund in future if it is managed well, said the BB official.

"The low-cost loans will be very useful for the garment sector, as the local scheduled banks charge higher interest rates," said Siddiqur Rahman, president of Bangladesh Garment Manufacturers and Exporters Association.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments