Apparel makers aim $1b from Japan despite dip

Shipments to Japan declined 3.7 percent to $945.47 million in the first 11 months of 2016-17 because of a fall in prices of goods and security concerns following the Holey Artisan attack in Dhaka last year, according to exporters.

Though the earnings fell 16.09 percent short of the Export Promotion Bureau's periodic target of $1.12 billion, exporters hope to cross the $1 billion mark by the end of the fiscal year, an achievement already made in the EU, the US and Canadian markets.

Japan is Bangladesh's single largest export destination among Asian nations and its market offers promising returns for quality apparel and leather and jute and associated goods.

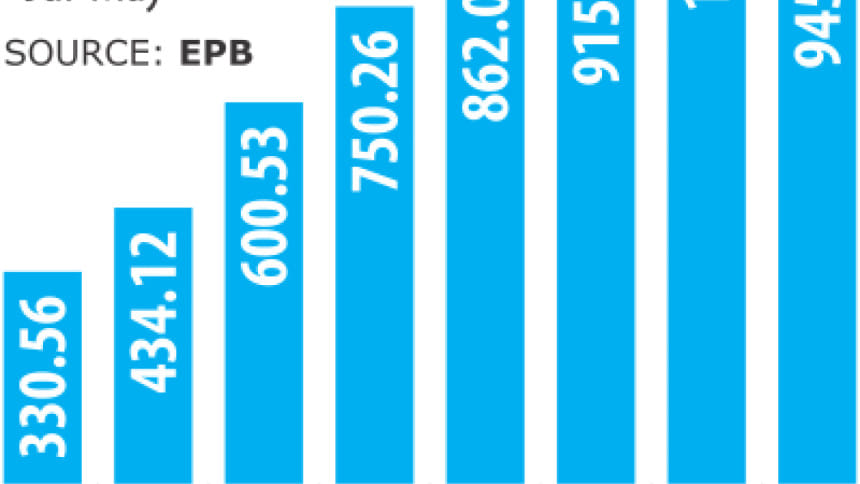

Exports to Japan have been soaring over the last few years maintaining nearly 20 percent growth every year.

Currently, Bangladesh's annual export earnings from other Asian countries such as China and India hovers around $700 million each.

Exports to Asian markets, especially to that of Japan, started rising as financial recessions of 2008 and 2009 affected the Western world badly.

Moreover, the Bangladesh government offers stimulus packages for exploring new destinations like Japan, China and India. Markets across the world, other than the traditional ones of the EU, the US and Canada, are considered as new destinations.

Another catalyst has been the relaxation of the Rules of Origin by the Japanese government on knitwear and woven garments from least developed countries.

This allowed Bangladesh to enjoy a zero-duty trade privilege and a competitive edge against countries like China, India and Pakistan in meeting Japan's annual demand for garments worth over $40 billion.

“Garment export from Bangladesh to Japan is rising every year. We are receiving a good response from the Japanese retailers,” said Mohammad Hatem, former vice-president of Bangladesh Knitwear Manufacturers and Exporters Association.

During the July-May period, Bangladesh exported garment goods worth $696.32 million to Japan, according to data from the EPB. Of this, $374.38 million came from woven items and $321.94 million from knitwear. Furthermore, the Japanese government adopted the China Plus One policy in 2008, which aims to reduce overdependence on China for goods like apparels, electronic gadgets and home appliances.

“Overall, the Japanese consumers are quality conscious. They tested Bangladeshi goods for years and have now started coming to Bangladesh,” said Tareq Rafi Bhuiyan, secretary general of Japan Bangladesh Chamber of Commerce and Industry.

Apart from apparel items, Bangladesh's leather, jute and allied items are performing strongly in the Far East Asian country, said Bhuiyan.

However, they are a bit concerned over security as the Japanese government raised an alert following the attack in Dhaka's diplomatic zone on July 1 last year when nine Italians, seven Japanese, three Bangladeshis and an Indian were killed. “Japan is a very promising market for us. We are expecting more export earnings,” said Bhuiyan.

He said Bangladesh has already selected a place at Narayanganj's Araihazar to set up a separate special economic zone for Japanese investors.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments